"A Tool for Financial Warfare" Indicator - Complete Guide

"Dominate the Markets with Precision – Turn Volatility into Victory!"

🔹 Overview

"A Tool for Financial Warfare" is a powerful MetaTrader 4 (MT4) indicator based on the RSX (Relative Strength eXplosion) oscillator. It helps traders identify overbought/oversold conditions, trend direction, and potential reversals with high accuracy.

This indicator is designed for aggressive traders who want to capitalize on momentum shifts and extreme market conditions.

🔹 How It Works

The indicator calculates the RSX oscillator, a smoothed momentum-based indicator that filters out market noise. It provides:

Overbought/Oversold Zones (Customizable levels)

Trend Direction Signals (Up/Down arrows)

Slope Changes (Momentum shifts)

Zone Entry/Exit Alerts (For timely trade execution)

Key Features:

✅ Multi-Timeframe Analysis – Works on any chart timeframe.

✅ Customizable OB/OS Levels – Adjustable thresholds (default: 20/80).

✅ Multiple Alert Systems – Desktop, email, push notifications.

✅ Visual Arrows – Clear entry/exit signals.

✅ Heiken Ashi Compatibility – Can be used with smoothed candles.

🔹 Indicator Settings & Parameters

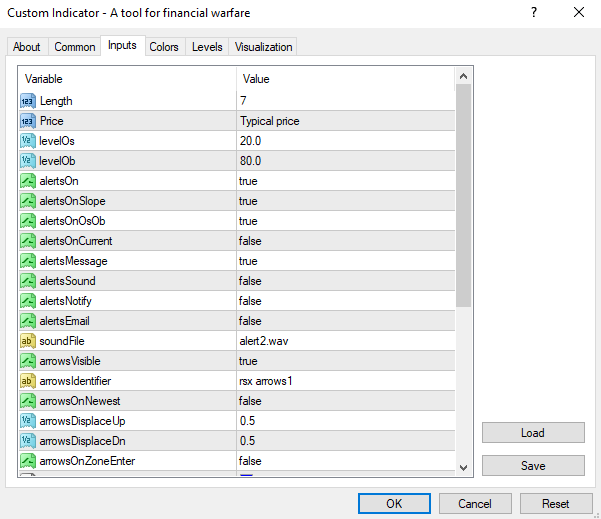

1. Main Inputs

Length (7) – Smoothing period for the RSX calculation.

Applied Price (PRICE_TYPICAL) – Price type used for calculations (Close, Open, Typical, etc.).

Level OS (20) – Oversold threshold.

Level OB (80) – Overbought threshold.

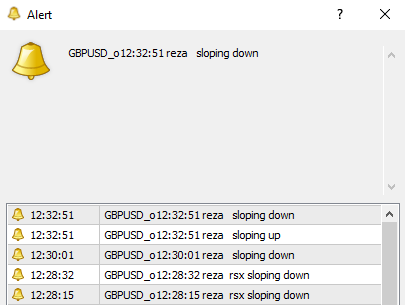

2. Alert Settings

Alerts On (True/False) – Enable/disable all alerts.

Alerts on Slope Change – Notifies when momentum shifts.

Alerts on OB/OS Zone Entry/Exit – Warns when price enters/exits overbought/oversold areas.

Desktop, Email, Push Notifications – Customizable alert methods.

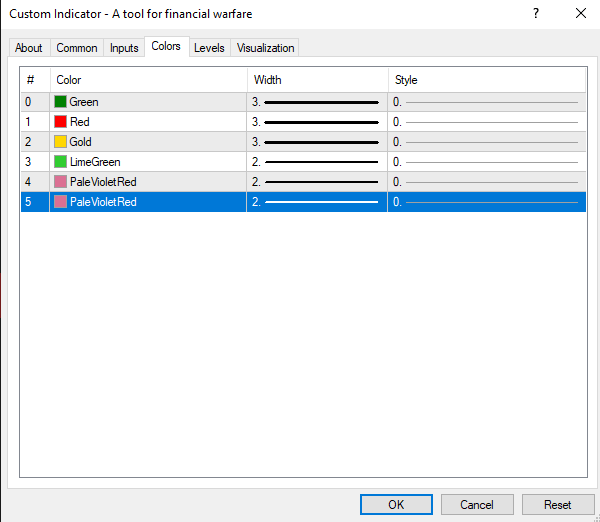

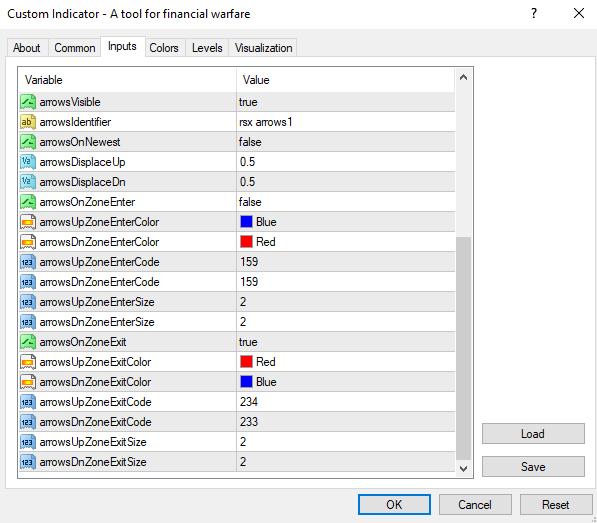

3. Arrow Display Settings

Arrows Visible (True/False) – Toggle arrows on/off.

Arrows on Zone Entry/Exit – Different colors for entering/exiting OB/OS zones.

Arrow Size & Style – Customizable appearance.

🔹 Trading Signals & Interpretation

🔸 Buy Signals (Long Trades)

RSX crosses above Oversold (20) + Slope turns upward → Potential reversal.

Blue Up Arrow → Strong bullish momentum.

🔸 Sell Signals (Short Trades)

RSX crosses below Overbought (80) + Slope turns downward → Potential reversal.

Red Down Arrow → Strong bearish momentum.

🔸 Additional Confirmation

Trend Continuation – If RSX stays in mid-range (20-80), follow the slope direction.

Divergence – If price makes higher highs but RSX makes lower highs → Possible reversal.

🔹 Recommended Trading Strategy

Wait for Extreme Zones – Enter trades when RSX hits OB (80) or OS (20).

Confirm with Slope – Ensure momentum aligns with the trade direction.

Use Stop Loss – Place stops beyond recent swing highs/lows.

Combine with Trend Filters – Use moving averages or price action for stronger confirmation.

🔹 Developer & Source

Developer: R.KH

Year: 2025

Website: https://www.robomql.com

"Trade Like a Strategist – Win the Financial War with RSX!" 💹🔥