ADR Indicator

ADR Indicator for MT4 provides expected market range acts as SUPPORT and RESISTANCE. Best forex trading strategy for breakout and reversals.

CATEGORIES: MT4, LEVELS, INFORMATIONAL

Updated on: 26.10.2023

The ADR Indicator for MT4 displays the ADR-range and the current day’s market range. So, the ADR provides an expected market range for the day. Moreover, a change in the trade volume and the momentum near the upper or lower ADR-level indicates a beginning of the trend or a reversal. ADR values form the basis of many other forex technical indicators and are part of a multitude of auto trading strategies.

The indicator is best suited for new and experienced forex traders. New traders can identify the ADR-levels as support and resistance and look for price action focusing around these levels. However, experienced traders can incorporate the indicator in other trading systems. Additionally, the indicator is free to download and easy to install.

ADR Indicator For MT4 Trading Setup

Promotion:

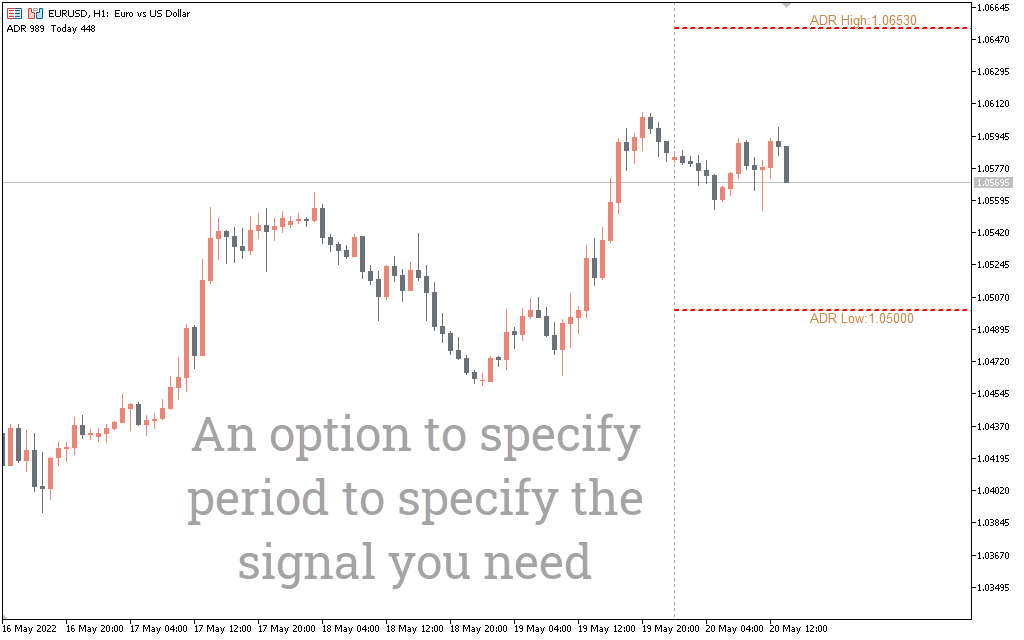

The above EURUSD H1 chart shows the indicator for MT4 in action. The indicator displays the ADR values and the current day’s range on the left top corner of the chart. Additionally, the indicator plots the upper and the lower range of Average Daily Range as a dotted line extending to the current trading day.

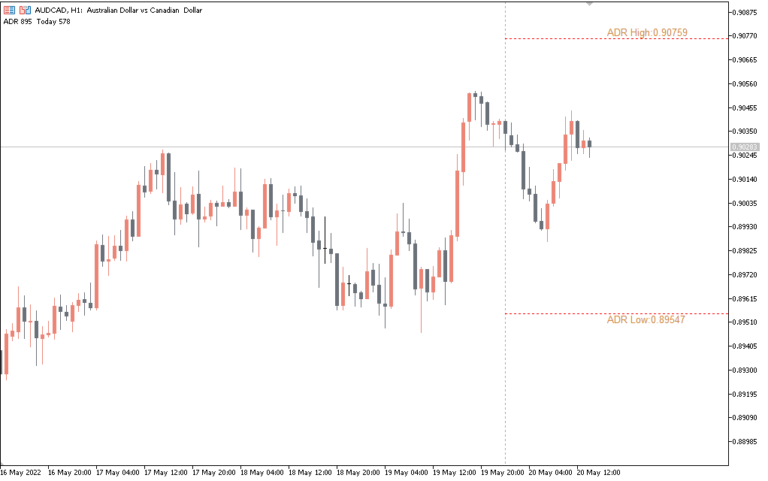

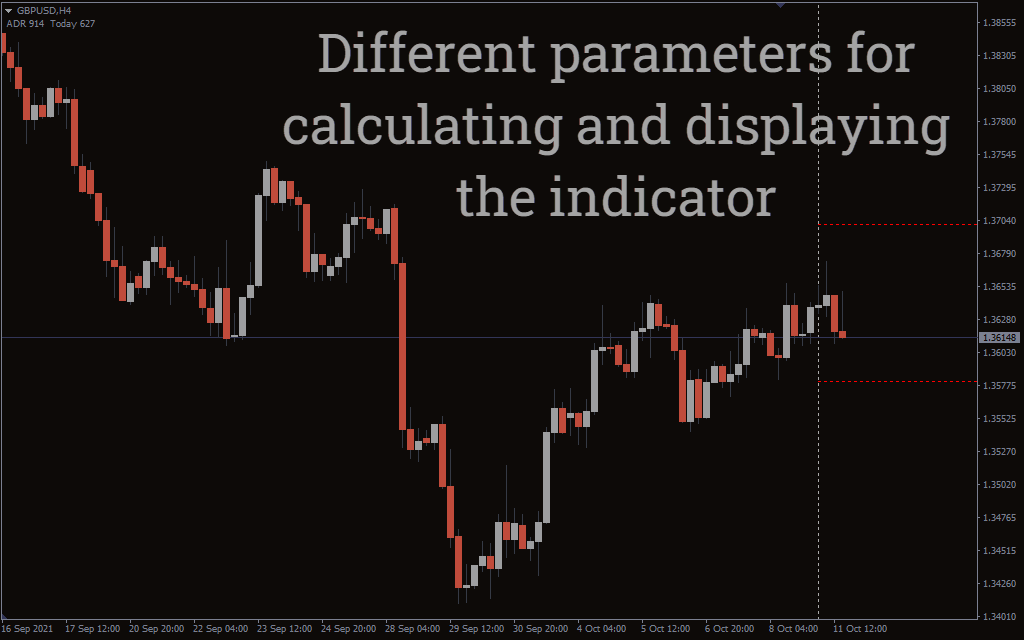

Average Daily Range MetaTrader indicator derives its values using the ATR – Average True Range MetaTrader indicator. So, the period of calculation of the Average Daily Range plays an important role in deciding the range. A smaller value of the ATR may result in the ADR-values of lower historical data. Similarly, a higher value uses larger data to calculate the ADR-values. So, technical forex traders should carefully choose the ATR input in the indicator settings to adapt to their trading strategy. However, as every currency pair has its volatility, forex traders should test and apply different ATR settings accordingly.

Forex traders can use breakout trading strategy and reversal trading strategy to trade using the Average Daily Range. As the ADR provides an expected market range, the forex trader can understand price extremes. So forex traders can BUY when the price reaches the lower ADR-level with a stop loss below the previous swing low. The best take profit for this position is the upper ADR level.

Similarly, forex traders can SELL once the price reaches the Upper ADR-line and find reversal signals.

The ADR levels show similar results in the intraday charts and act as intraday support and resistance levels. So price action around the upper or lower ADR levels provides the best clue to the trader about concluding whether it is a reversal or breakout.