Average Range Indicator - Comprehensive Guide

🏆 Motto:

"Trade with Precision – Let the Average Range Illuminate Your Path to Profitable Decisions!"

📌 Overview

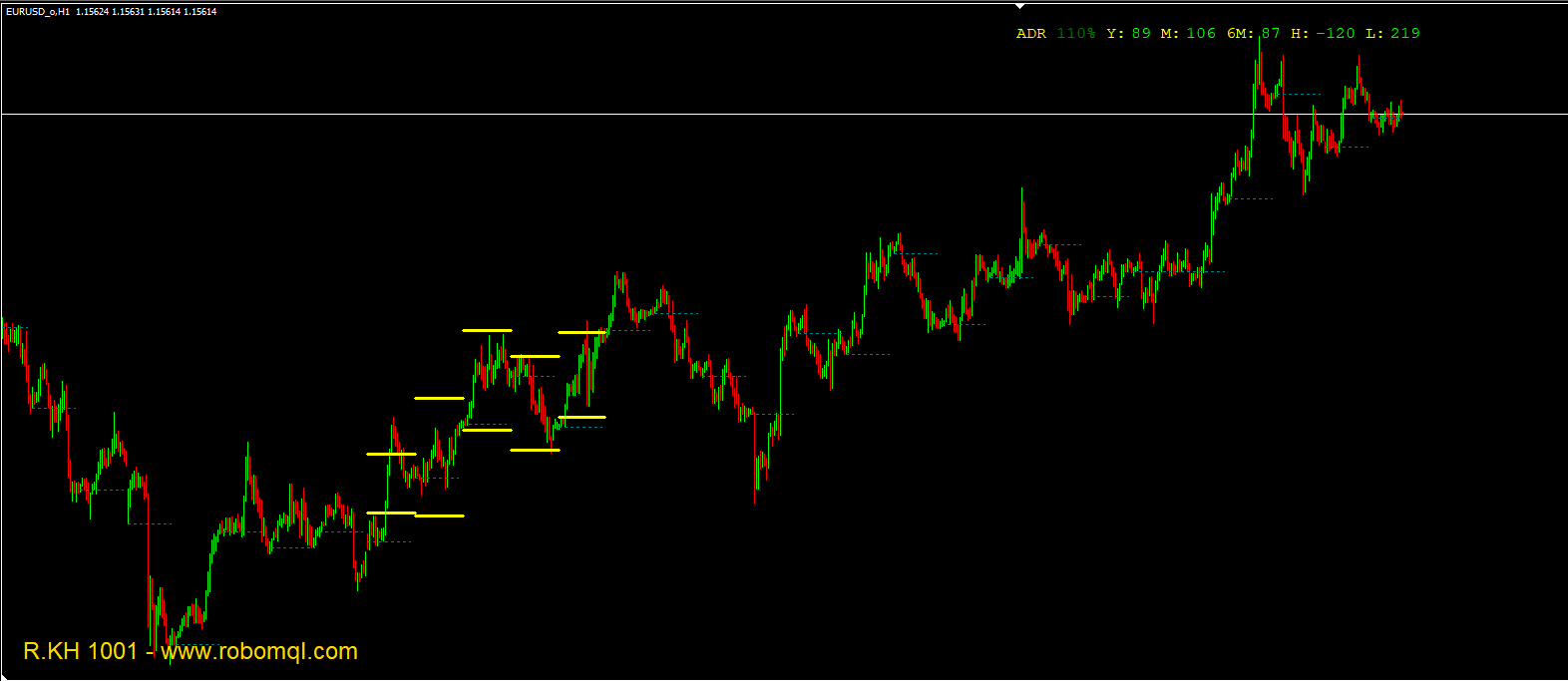

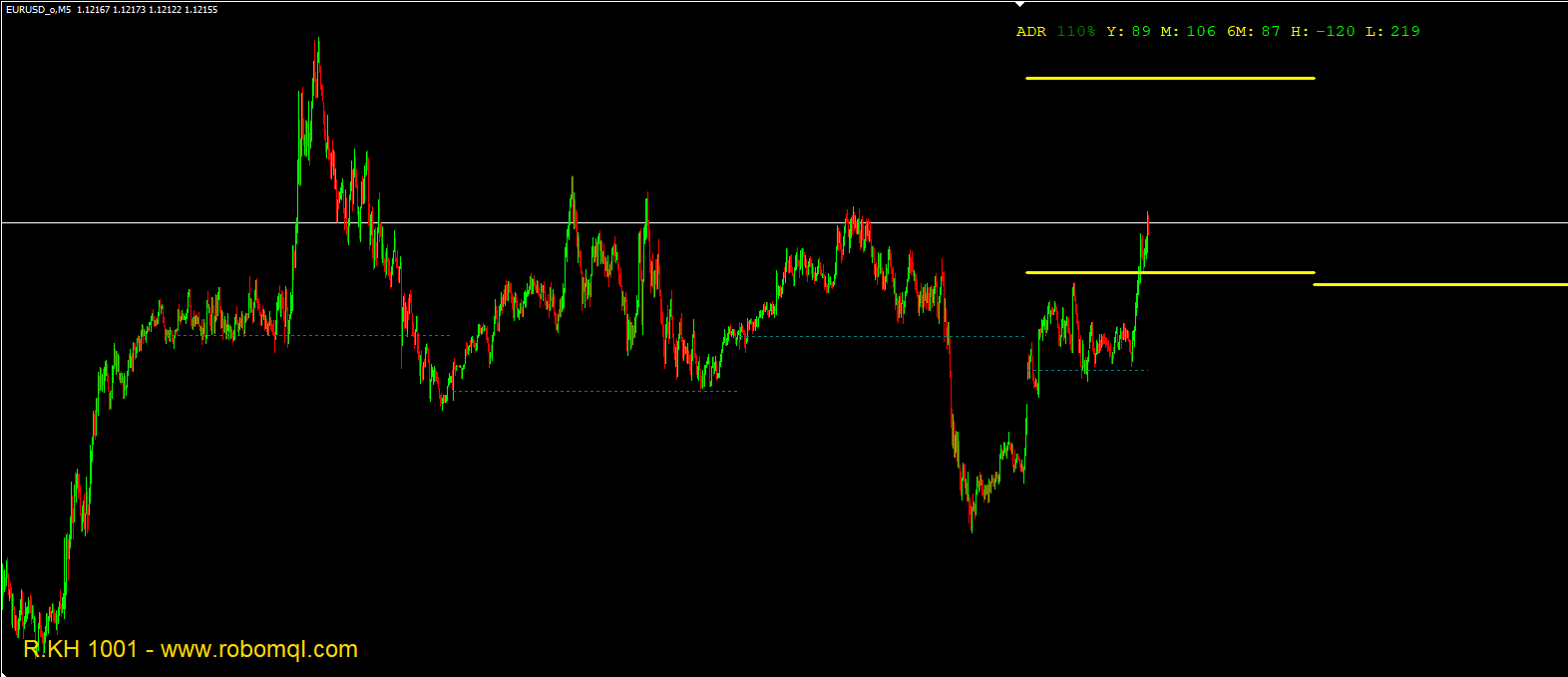

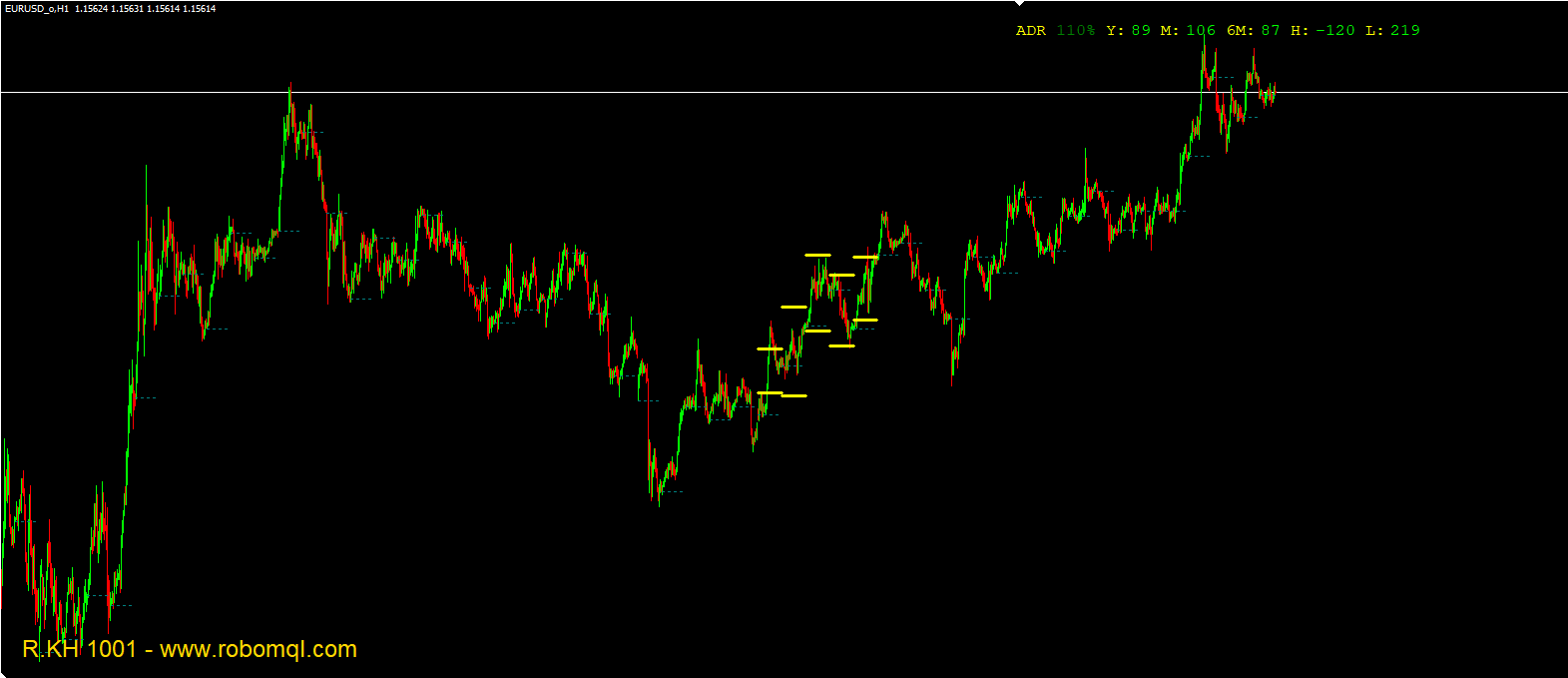

The Average Range (ADR) Indicator is a powerful MetaTrader 4 (MT4) tool developed by R.KH 1001 that helps traders analyze price volatility across multiple timeframes. This indicator calculates and displays key metrics including:

Daily/Weekly/Monthly Average True Ranges

Current Day's High/Low

ADR Percentage (showing how much of the average range has been covered)

Historical High/Low Lines

Available on RoboMQL, it's ideal for breakout traders, swing traders, and volatility-based strategies.

🔧 How It Works

The indicator:

Calculates Average Daily Range (ADR) – Based on historical price movement

Plots Key Levels – Shows where price is relative to its typical range

Visualizes Volatility – Color-codes ADR percentage (green=above average, red=below)

Multi-Timeframe Analysis – Displays YTD, 6-month, and monthly averages

⚙️ Indicator Settings

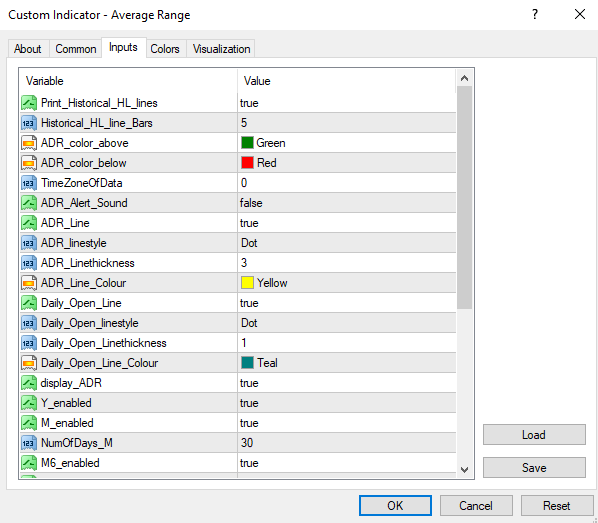

Core Parameters

ParameterDescriptionDefault

Print_Historical_HL_linesShows previous days' high/low linestrue

Historical_HL_line_BarsNumber of historical bars to display5

ADR_Alert_SoundAlerts when ADR exceeds 100%false

TimeZoneOfDataAdjusts for broker timezone differences0

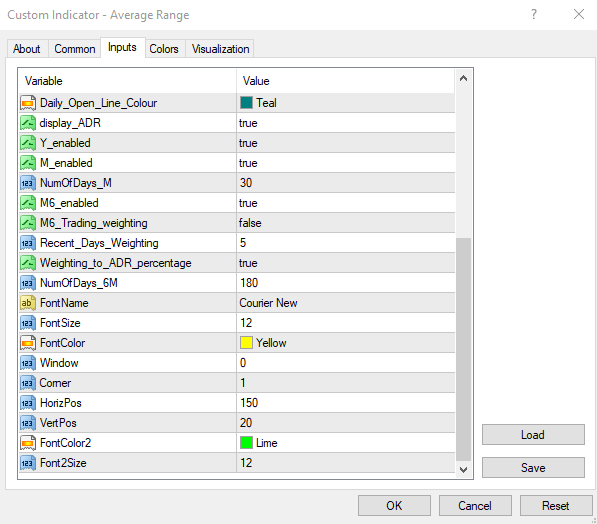

Visual Customization

Line Colors: Configure ADR lines, daily open, and high/low markers

Line Styles: Dotted/dashed/solid options for each element

Text Display: Font size, color, and positioning controls

Timeframe Options

Enable/disable Year-to-Date (Y), 6-Month (6M), and Monthly (M) calculations

Adjust lookback periods (NumOfDays_D, NumOfDays_M, etc.)

📊 Key Features

1. ADR Calculation

Shows how much of the average range has been covered (as percentage)

Color-coded alerts for high/low volatility conditions

2. Historical High/Low Lines

Projects previous days' ranges onto current chart

Helps identify potential support/resistance zones

3. Multi-Timeframe Volatility Analysis

Compare current volatility against:

1-month average

6-month average

Year-to-date average

4. Smart Weighting System

Optional recent day weighting for more responsive calculations

Configurable ADR percentage or pips display

📈 Practical Applications

For Breakout Traders

Enter when price approaches historical ADR high/low

Stay out when 50% of ADR is covered (low volatility)

For Range Traders

Fade moves near ADR extremes

Use daily open line as mean-reversion point

Risk Management

Adjust position sizing based on current volatility

Set stops beyond key ADR levels

⚡ Pro Tips

Combine with volume indicators to confirm breakouts

Watch for ADR 100% days – often signal trend acceleration

Use monthly ADR in earnings season for stocks/indices

👨💻 Developer & Source

Developer: R.KH 1001

Website: RoboMQL

🌟 Why Traders Love It

"The ADR Indicator transformed my trading – I now enter only when volatility aligns with my strategy, avoiding false breakouts during low-ADR periods." – *Forex Trader, 5+ Years Experience*

Trade Smarter with Data-Driven Volatility Insights! 📊