Average True Range Value Indicator

Average true range (ATR) is a technical analysis volatility indicator originally developed by J. Welles Wilder, Jr. for commodities. The indicator does not provide an indication of price trend, simply the degree of price volatility.

CATEGORIES: MT4, INFORMATIONAL

Updated on: 11.10.2023

There usually comes a time in the journey of a forex trader when they are not only concerned with market trends, but also the volume behind those trends. Because knowing how much volume there is behind every trend helps to filter out minor trends from major trends. This knowledge has driven many professional forex traders to turn to the average true range (ATR) value indicator. This volatility determining indicator has then become an indispensable tool for such tasks on the MT4 and other trading platforms.

The indicator we will look at is a simplified analogue of the ATR indicator, which is already installed by default in the MT4 Terminal. But it has a number of advantages, which we will tell in the article.

The Average True Range Value Indicator On MT4

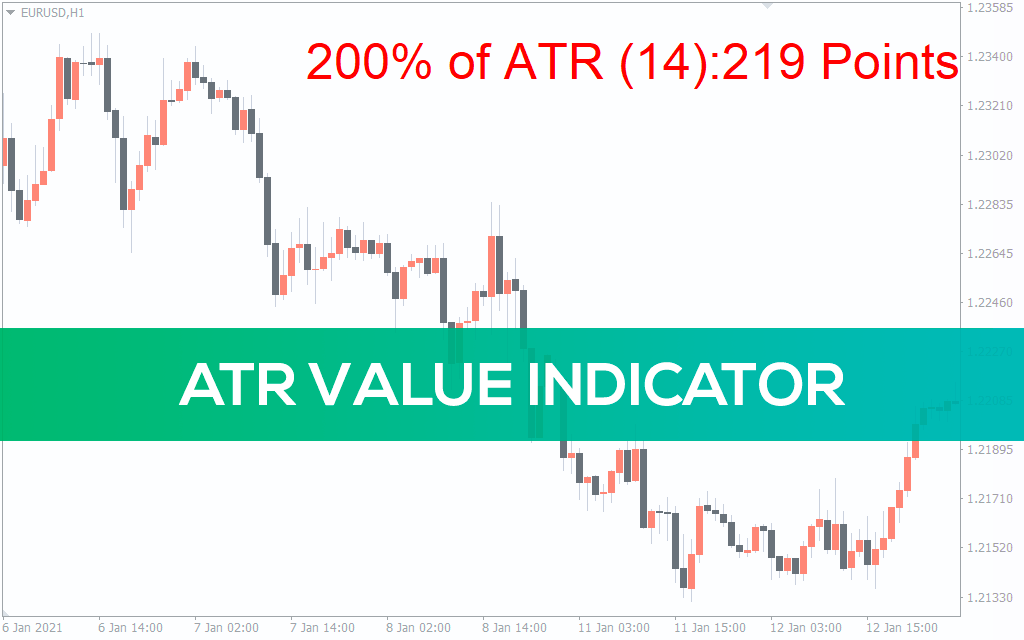

The average true range (ATR) indicator determines the volatility of the market. In other words, it portrays the average size of price movements for a given asset over a period. When you use the average true range on MT4, it displays as a line that goes up and down the indicator window. The higher the ATR value, the more volatile the market is. And the lower the ATR value, the less volume there is in the market.

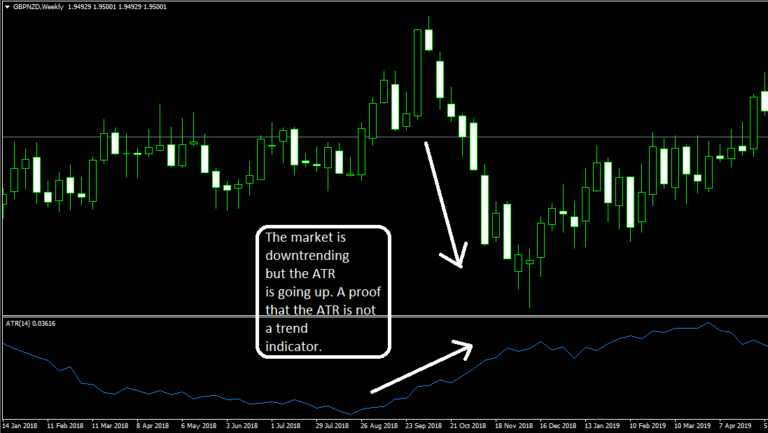

A mistake many traders make is that they try to trade trends with the ATR. Unfortunately, they might as well be trying to fit square pegs in round holes. The ATR indicator does not tell the trend of the market. There are even times, as in the image below, when the market is trending in one direction but the ATR slopes in the opposite direction.

If you are then wondering what the ATR is used for, here are some common uses of the ATR indicator.

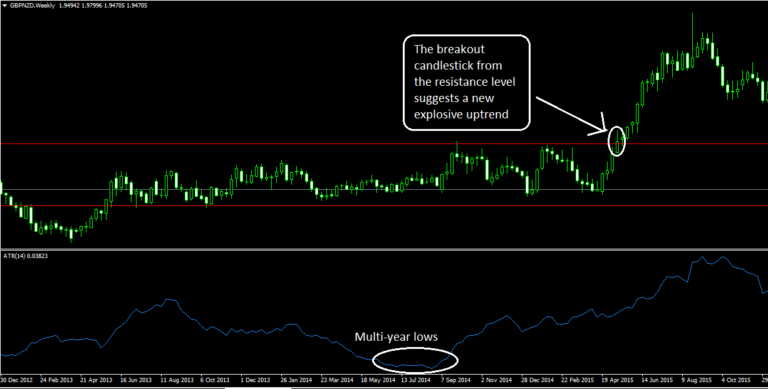

A trader can use the ATR value indicator to determine the best time to enter trades. The ATR can help you determine if there is enough volume in the market for you to trade. It also keeps you out of dead or inactive markets.

You can also use the ATR indicator to determine stop loss positions.

There are also ways to use the ATR as an exit indicator.

How Is Indicator Calculated?

As the name implies, the average true range is the average of the price range values of an asset over a period. But there are three different ways to calculate the true range of an asset.

Subtract the previous low from the current high

Subtract the previous close from the current low

Subtract the current low from the current high

The ATR calculates those true ranges and uses the greatest among them as the true range for that period. Note that the ATR does not take the positivity or negativity of the number into consideration. Negative 56 (-56) is the same as positive 56 (+56) as far as the volume telling indicator is concerned.

Now that the formula for the true range for each period is known, the ATR just averages these values over a given period. The default ATR period on Metatrader 4 trading platform, for example, is 14. So, the ATR calculates the true ranges over the last 14 candlesticks and uses the values to construct a continuous line.

How To Trade With The Average True Range Indicator?

This is the part that interests many traders, and for the right reasons. What’s most important is how to implement the ATR indicator in your trading.