Boomerang EA MT4

Boomerang EA is a trend-focused Expert Advisor designed for MT4, offering consistent performance in trending markets. Discover its settings, strategy insights, and my personal review as a professional trader.

Boomerang EA is a cutting-edge trend-following Expert Advisor developed for MetaTrader 4. This EA is tailored for traders looking to capitalize on strong market trends with precision entries and effective risk management. Unlike many automated systems that falter in volatile or range-bound conditions, Boomerang EA shows its true potential in trending markets, making it a preferred choice for traders who focus on trend trading strategies.

As a professional trader, I have rigorously tested Boomerang EA across different market conditions, and its performance stands out, especially in trending environments. In this article, I will delve into its settings, strategy, performance analysis, and my expert opinion on its usage.

Recommended Settings

Currency Pairs: EUR/USD, GBP/USD, USD/JPY

Timeframes: H1 and H4

Leverage: 1:100 or higher (preferably 1:200 for optimal performance)

Account Type: ECN or Raw Spread accounts (to minimize trading costs and slippage)

Features of Boomerang EA for MT4

Boomerang EA is built on advanced trend detection algorithms, utilizing indicators such as ADX and moving averages to identify strong directional movements. It features customizable risk management, including stop-loss and take-profit levels, and allows for dynamic lot sizing based on the trader’s risk appetite. The EA also has a built-in news filter to avoid trading during high-impact events, reducing the risk of unexpected market volatility.

Boomerang EA Strategy

Boomerang EA is a trend-following system that leverages key indicators like the Average Directional Index (ADX) to assess trend strength and determine entry points. The EA opens trades in the direction of the trend once certain conditions are met, such as a confirmed ADX crossover and a strong directional move. It employs trailing stops to lock in profits as the trend progresses, and it closes trades when the trend shows signs of reversal or weakening.

Throughout my testing, I found that Boomerang EA’s strategy excels in trending markets, where it can effectively ride strong price movements. However, it tends to underperform during extended periods of consolidation or range-bound conditions, as false signals can lead to frequent stop-outs. The dynamic risk management settings help mitigate these losses by adjusting position sizes based on volatility.

Performance and Drawdowns

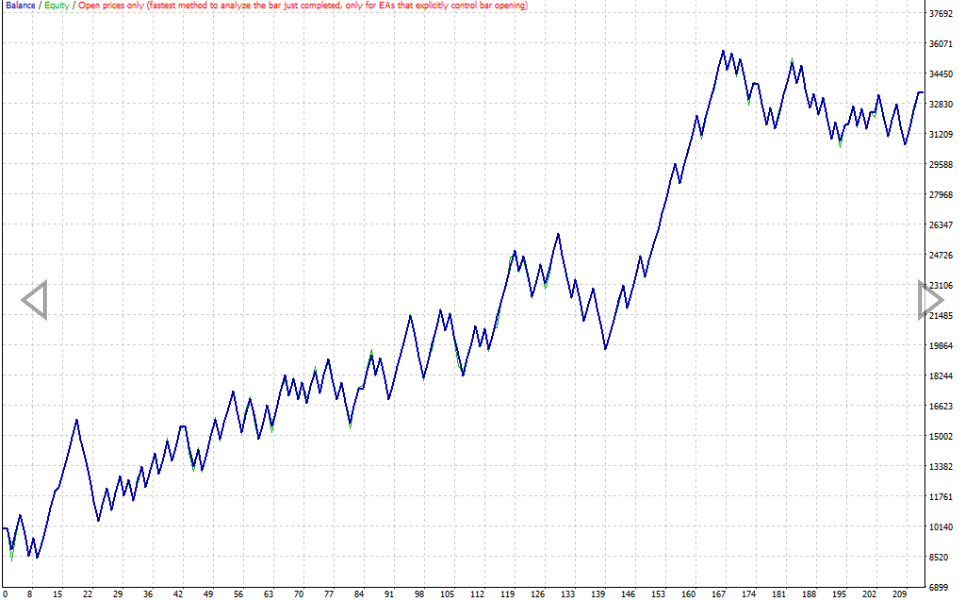

The backtesting results of Boomerang EA show a consistent equity curve with minimal drawdowns when applied to trending markets. The EA’s trailing stop mechanism helps capture large price moves while minimizing potential losses. However, during periods of market congestion, I observed a slight increase in drawdown, primarily due to false breakouts and trend reversals.

In live trading, Boomerang EA performed as expected in trending phases, delivering steady profits with a controlled risk profile. The drawdowns remained within acceptable limits, but it’s important to note that the EA requires active monitoring during range-bound markets to avoid prolonged drawdowns.

Conclusion

Overall, Boomerang EA is a strong addition to any trader’s arsenal, particularly for those who focus on trend trading strategies. With proper settings and active market monitoring, it can deliver impressive returns while maintaining a disciplined risk approach.