Controversial Colors Indicator - Complete Trading Guide

"When Markets Speak in Colors, Smart Traders Listen!"

📌 Overview

The Controversial Colors Indicator is a unique MT4 tool that visualizes market trends through a color-coded histogram system. It combines multiple moving averages with volatility filters to identify high-probability trading opportunities across all financial markets.

Key Features:

✅ Triple MA Convergence System - Uses 3 different period MAs for robust trend detection

✅ ATR-Based Volatility Filter - Eliminates false signals in choppy markets

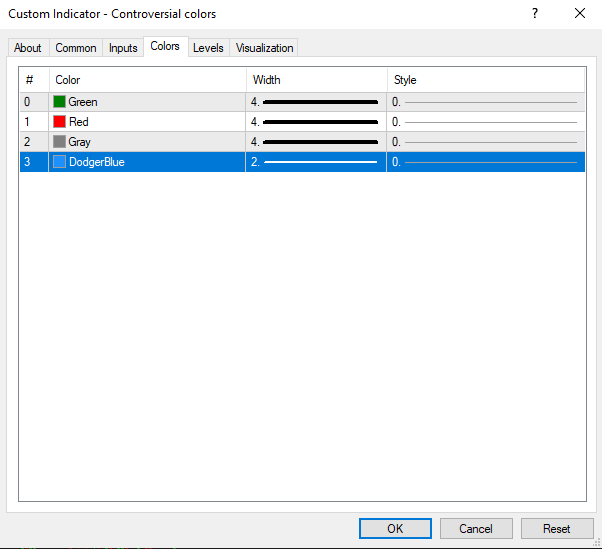

✅ Visual Color Signals - Instant trend recognition (Green=Up, Red=Down, Gray=Neutral)

✅ Customizable Parameters - Adaptable to any trading style or timeframe

⚙️ How It Works

The indicator analyzes the relationship between three moving averages:

Fast MA (Green) - Short-term trend direction

Medium MA (Red) - Intermediate trend

Slow MA (Gray) - Long-term trend confirmation

Signal Logic:

Green Bars = Fast MA Medium MA with sufficient separation (strong uptrend)

Red Bars = Medium MA Fast MA with sufficient separation (strong downtrend)

Gray Bars = Insufficient separation between MAs (consolidation)

Blue Line = Dynamic volatility threshold (ATR-based filter)

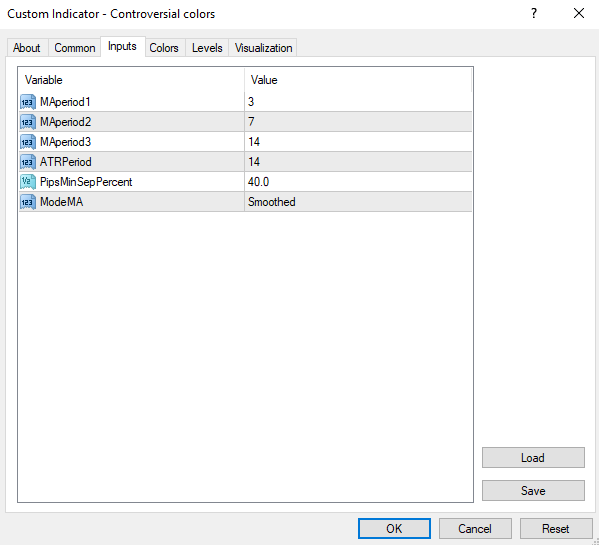

🔧 Indicator Settings

1️⃣ Moving Average Parameters

MAperiod1 (Default: 3) - Fast MA period

MAperiod2 (Default: 7) - Medium MA period

MAperiod3 (Default: 14) - Slow MA period

ModeMA (Default: MODE_SMMA) - Smoothing method:

MODE_SMA | MODE_EMA | MODE_SMMA | MODE_LWMA

2️⃣ Volatility Filters

ATRPeriod (Default: 14) - ATR period for volatility measurement

PipsMinSepPercent (Default: 40) - Minimum separation threshold (% of ATR)

📊 Trading Strategies

🔹 Trend-Following Approach

Enter Long when green bars appear above blue filter line

Enter Short when red bars appear below blue filter line

Exit when color changes to gray or crosses filter line

🔹 Reversal Strategy

Watch for color changes after prolonged trends

Gray bars often precede reversals

🔹 Best Practices

✔ Works best on H1-D1 timeframes for swing trading

✔ Combine with support/resistance levels for confirmation

✔ Adjust ATR period for different volatility conditions

📌 Important Notes

More sensitive settings (lower periods) work better for scalping

Higher PipsMinSepPercent values reduce signals but increase quality

The blue filter line adapts to changing market volatility

🔹 Developer & Source

Developer: R.KH (2025)

Official Website: www.robomql.com

"Trade What You See, Not What You Hope - Let Colors Guide Your Way!" 🎨📊