Detailed Explanation of the "Fast Money" fast money

This custom indicator is a modified version of the Stochastic Oscillator, designed to provide clear trading signals with visual enhancements. Below is a complete breakdown of its features, calculations, and usage.

1. General Overview

Indicator Name: Fast Money

Developer: Reza

Platform: MetaTrader 4 (MT4)

Type: Separate window oscillator (0-100 scale)

Main Purpose: Identifies overbought/oversold conditions and potential trend reversals.

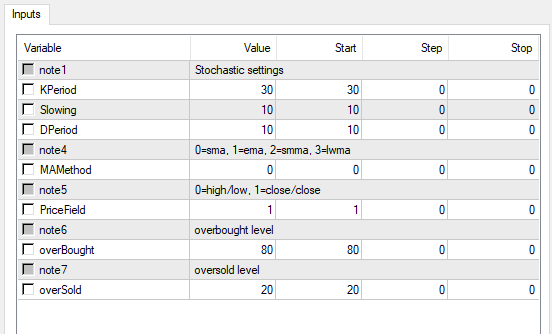

2. Input Parameters

Stochastic Settings

KPeriod (Default: 30) – The lookback period for %K (fast line).

Slowing (Default: 10) – Smoothing applied to %K.

DPeriod (Default: 10) – The moving average period for %D (slow line).

Moving Average Method

MAMethod (0-3) – Defines the type of MA used for smoothing:

0 = SMA (Simple Moving Average)

1 = EMA (Exponential Moving Average)

2 = SMMA (Smoothed Moving Average)

3 = LWMA (Linear Weighted Moving Average)

Price Field

PriceField (0-1) – Determines the price source for calculations:

0 = High/Low (Traditional Stochastic method)

1 = Close/Close (Alternative method using closing prices)

Overbought/Oversold Levels

overBought (Default: 80) – Upper threshold for overbought conditions.

overSold (Default: 20) – Lower threshold for oversold conditions.

3. Indicator Buffers

The indicator uses 4 buffers (arrays storing calculated values):

Buffer IndexNameDescriptionColorStyle

0DFull%D (Slow line)DimGrayLine (if DPeriod 1)

1KFull%K (Fast line)DimGrayLine

2UpperOverbought zone highlightsLimeThick Line

3LowerOversold zone highlightsRedThick Line

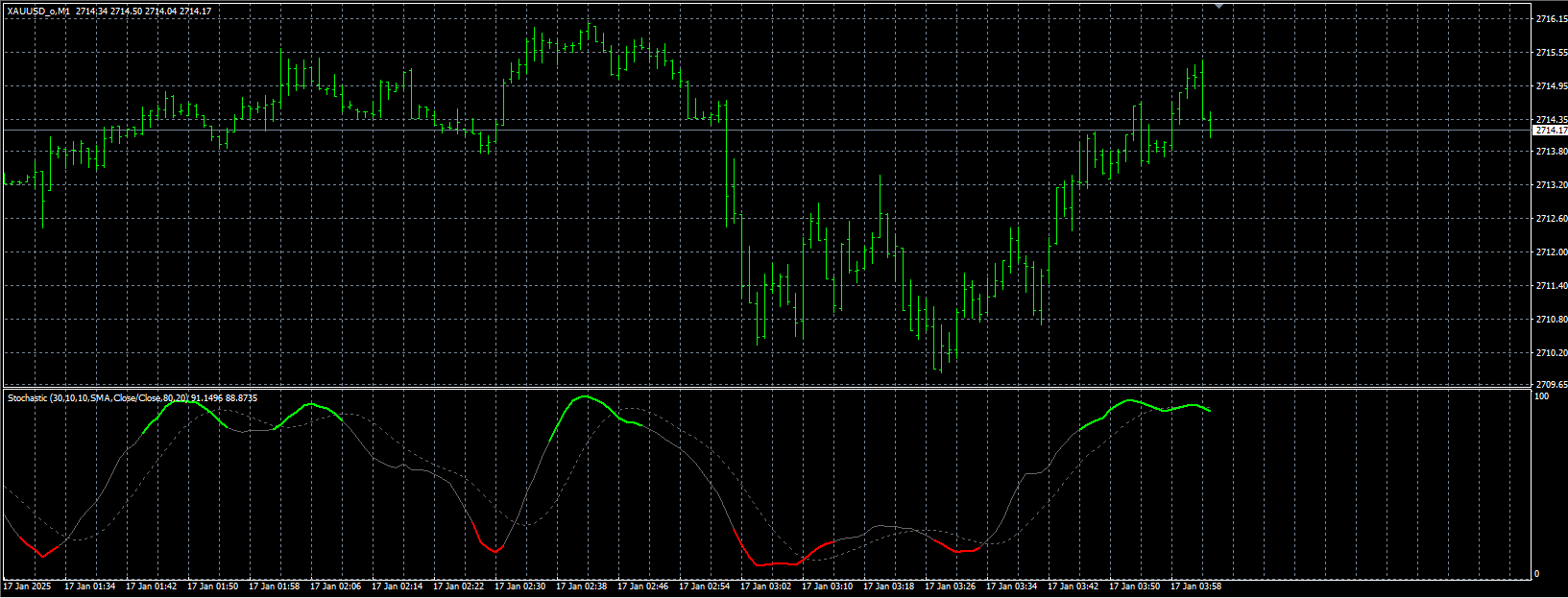

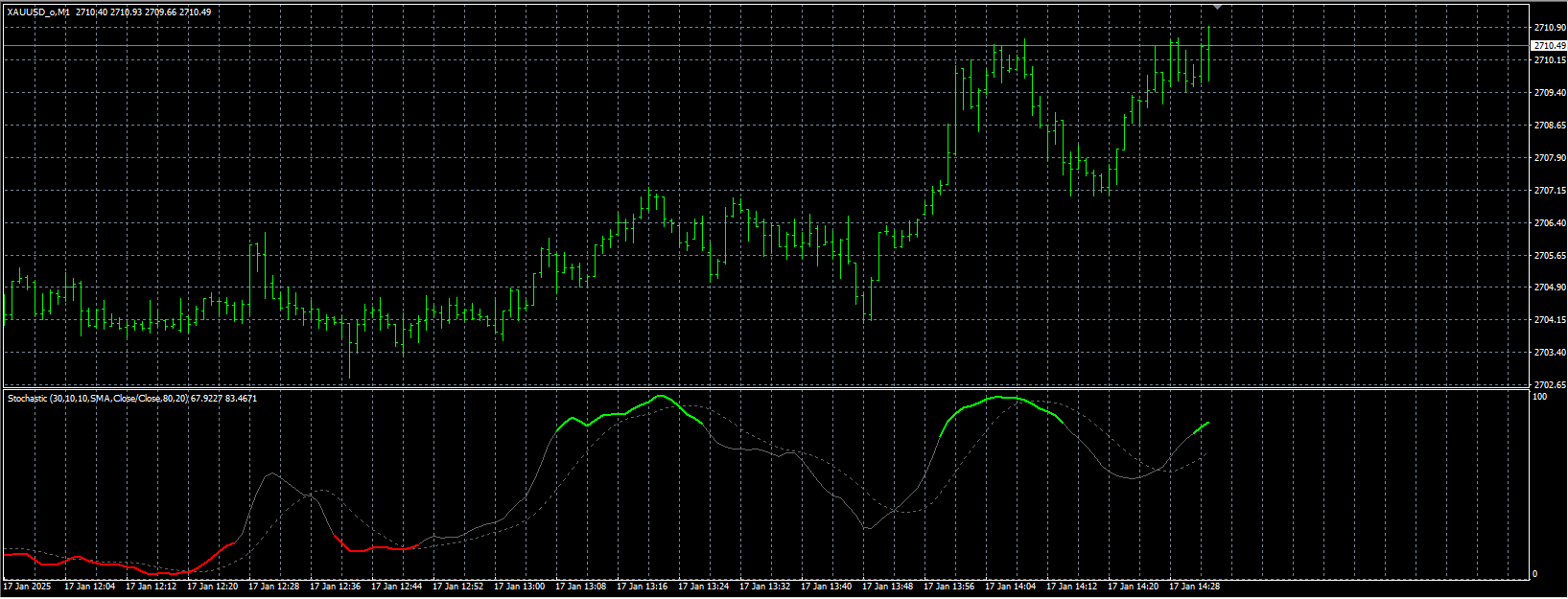

4. How It Works

Calculation Logic

%K (Fast Line):

Calculated using iStochastic() with the specified KPeriod, Slowing, and MAMethod.

If PriceField = 0, it uses High/Low prices.

If PriceField = 1, it uses Close/Close prices.

%D (Slow Line):

A moving average of %K (DPeriod determines smoothing).

If DPeriod = 1, the slow line is hidden.

Overbought/Oversold Highlighting:

When %K overBought (80), the Upper buffer marks the value in Lime.

When %K overSold (20), the Lower buffer marks the value in Red.

Visual Enhancements

Thick Lines: Overbought/oversold levels are highlighted with thicker lines.

Dynamic Plotting: Only shows highlights when conditions are met (avoids cluttering).

5. Trading Signals

Buy Signal (Oversold)

When %K crosses above overSold (20) → Potential bullish reversal.

Confirmation: %K crosses above %D (bullish crossover).

Sell Signal (Overbought)

When %K crosses below overBought (80) → Potential bearish reversal.

Confirmation: %K crosses below %D (bearish crossover).

Divergence Detection

Bullish Divergence: Price makes lower lows, but Stochastic makes higher lows.

Bearish Divergence: Price makes higher highs, but Stochastic makes lower highs.

6. Recommended Settings

Trend-Following: KPeriod=35, Slowing=10, DPeriod=1 (for smoother signals).

Scalping: KPeriod=14, Slowing=3, DPeriod=3 (faster reactions).

Default: KPeriod=30, Slowing=10, DPeriod=10 (balanced approach).

7. Advantages

✅ Clear Visuals: Overbought/oversold zones are highlighted for easy spotting.

✅ Customizable Smoothing: Adjust MA type for different market conditions.

✅ Flexible Price Input: Choose between High/Low or Close/Close calculations.