Financial Chaos Indicator - Complete Trading Guide

"Master Market Turbulence - Turn Chaos Into Consistent Profits!"

🔹 Overview

The Financial Chaos indicator is an advanced MetaTrader 4 tool that combines ZigZag patterns, moving averages, and volatility analysis to identify high-probability trend reversals and profit-taking opportunities. Designed for traders navigating volatile markets, it provides clear visual signals for entries, exits, and trend confirmation.

Key Features:

✅ Multi-Timeframe Analysis - Works across all chart periods

✅ Smart Trend Identification - Detects emerging trends early

✅ Profit-Taking Signals - Flags optimal exit points

✅ Customizable Alerts - Desktop, email, and sound notifications

✅ Visual Arrow System - Color-coded signals for easy interpretation

🔹 How It Works

The indicator uses a sophisticated algorithm that:

Analyzes Price Waves (ZigZag pattern detection)

Smooths Data (Special moving average calculations)

Identifies Extremes (Peak/trough detection)

Generates Signals (Entry/exit arrows with trend confirmation)

Signal Types:

🔵 Blue Up Arrow - Strong bullish trend signal

🔴 Red Down Arrow - Strong bearish trend signal

🟢 Green TP Arrow - Buy take profit signal

🟠 Orange TP Arrow - Sell take profit signal

🔹 Indicator Settings & Parameters

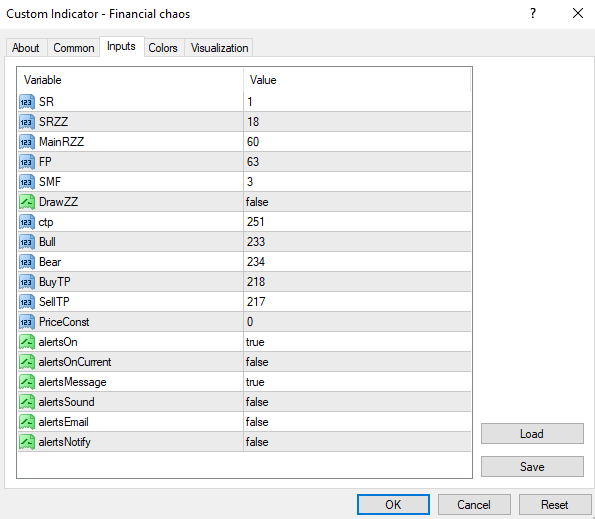

1. Core Configuration

ParameterDefaultDescription

SR1Sensitivity of initial smoothing

SRZZ18Short-term ZigZag sensitivity

MainRZZ60Main ZigZag period

FP63Filter period for extremes

SMF3Smoothing factor multiplier

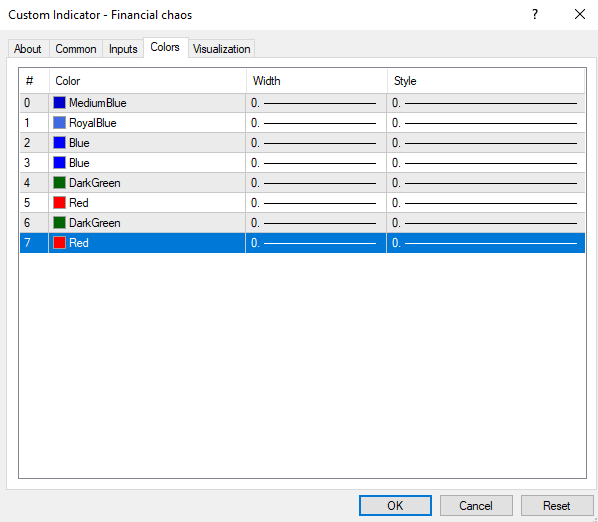

2. Visual Settings

FeatureOptionsDescription

DrawZZOn/OffToggle ZigZag lines

Arrow CodesCustomChange arrow symbols

Price Source6 optionsSelect price calculation method

3. Alert System

Trend Change Alerts - When new trend detected

TP Alerts - When profit targets reached

Notification Methods - Popup, email, sound, mobile

🔹 Trading Strategy Recommendations

Entry Techniques

Trend Following

Enter long when blue up arrow appears

Enter short when red down arrow appears

Confirm with ZigZag direction

Mean Reversion

Fade extremes when price reaches TP arrows

Combine with overbought/oversold indicators

Risk Management

Stop Placement - Below recent swing low (longs) / Above swing high (shorts)

Profit Targets - Use TP arrows as initial targets

Position Sizing - Reduce size in high volatility (chaotic markets)

Timeframe Combinations

Intraday - Use 5M-30M with SR=2, SRZZ=12

Swing Trading - Use H4-D1 with SR=3, SRZZ=20

Position Trading - Use W1-MN with MainRZZ=100+

🔹 Advanced Tips

Divergence Trading - Look for price/indicator divergences at extremes

Multi-Timeframe Confirmation - Check higher timeframe trend direction

News Filter - Avoid trading during high-impact news when chaos peaks

🔹 Developer & Source

Developer: R.KH

Year: 2025

Website: https://www.robomql.com

"In Market Chaos Lies Opportunity - Let This Indicator Be Your Guide Through the Storm!" 🌪️📈