FXSSI.OrderBook

Open trades and pending orders of retail traders are displayed as a two-sided histogram.

Version

1.088

Platform

MT4MT5

First Release

Mar. 1, 2023

Last Update

Mar. 1, 2023

Category

Sentiment

Developed by

FXSSI team

Patch Notes

System Requirements

FXSSI.OrderBook

Analyze the market sentiment directly in the MT4 and MT5 terminal with the advanced OrderBook indicator.

The indicator will allow you to:

Identify the levels with the largest Stop Loss clusters;

Evaluate the chances of bulls or bears to develop the “attack”;

Distinguish false moves from the true ones;

And more.

The indicator will become an indispensable assistant for any trader who practices trading against the market majority.

Some of our clients admit that the given indicator is addictive, and they can no longer imagine their market analysis without it.

OrderBook Indicator

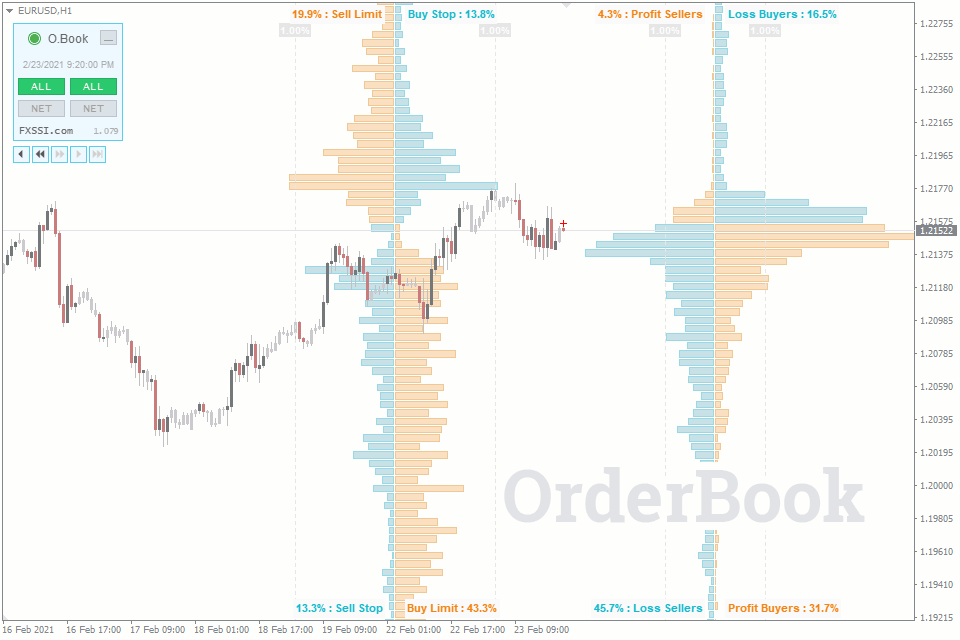

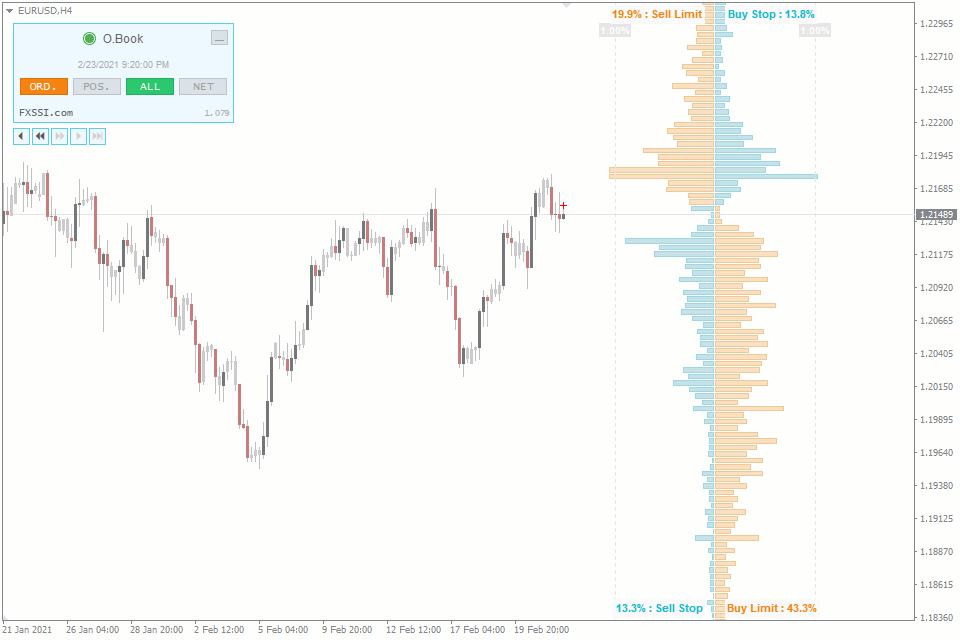

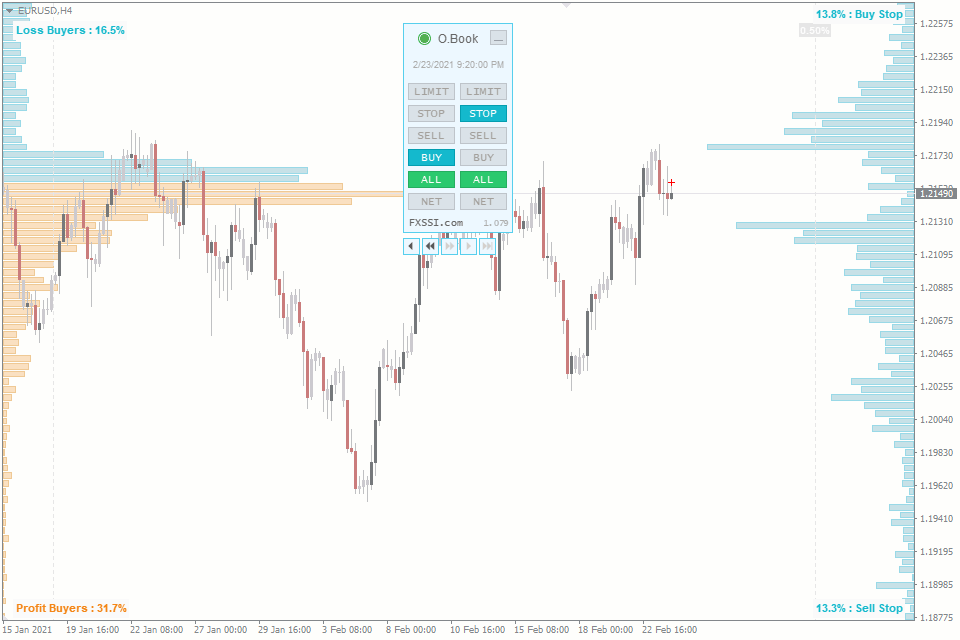

The OrderBook indicator displays open trades and pending orders of retail traders as a two-sided histogram. It is used for the comprehensive analysis of market sentiment for a particular financial instrument.

The OrderBook indicator consists of two parts:

Left-side order book, which displays all pending orders, including Take Profits and Stop Losses.

Right-side order book, which shows currently open trades of market participants.

The order books further divide into quarters, each of which displays a specific order type, such as Sell Limit, Buy Stop, Profit Sellers or Loss Buyers, etc.

By analyzing this kind of information and resorting to various patterns of the market crowd behavior, you can make complete trading decisions.

Trading With the OrderBook Indicator

First of all, you should understand that Order Book does not generate clear-cut signals like, for example, some indicators that draw arrows on the chart indicating Buy or Sell recommendations.

When it comes to the Order Book, the market analysis comes down to searching for existing or non-existing abnormal clusters among sellers and buyers.

The basic algorithm for the market analysis using the Order Book is as follows:

How to trade with a OderBook

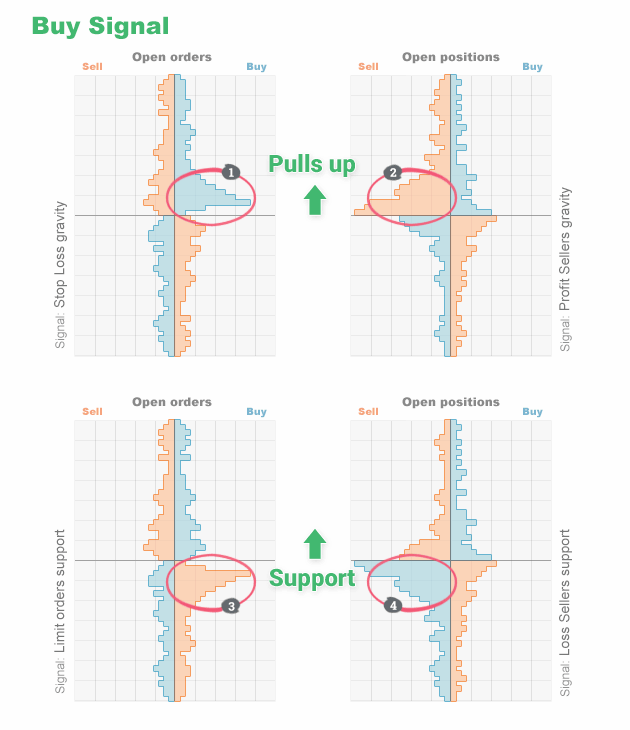

For Buy trades:

Clusters of sellers’ Stop Losses attract the price;

Dominant winning sellers pull the price up;

Clusters of Buy Limit orders act as support;

Dominant losing sellers push the price up.

How to trade with a OderBook

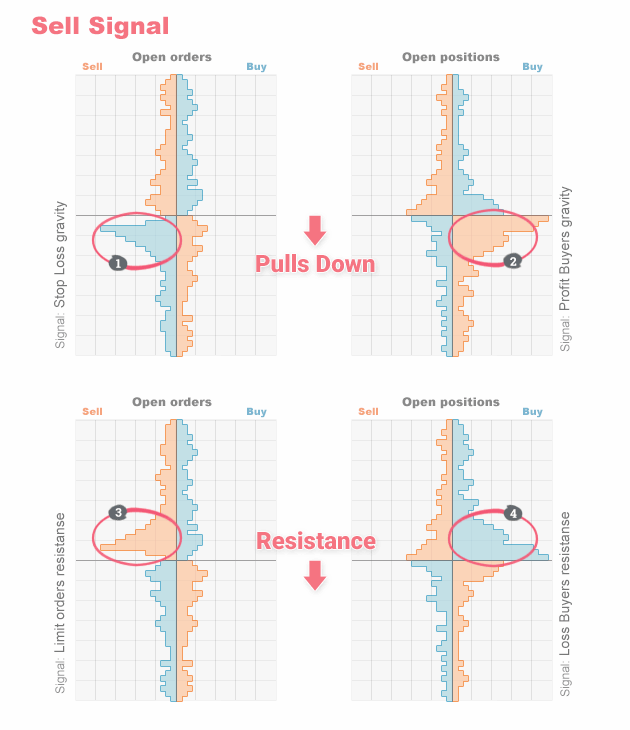

For Sell trades:

Clusters of buyers’ Stop Losses attracts the price;

Dominant winning buyers pull the price down;

Clusters of Sell Limit orders act as resistance;

Dominant losing buyers push the price down.

However, this doesn’t mean that you should immediately open a Sell trade when you see, for example, a cluster of winning buyers.

We can give you a 100-percent guarantee that initially, you will see the things that aren’t there in the market. Therefore, you need some practice to distinguish signals by their quality and validity.

Trading with the Order Book also requires a little more in-depth analysis in each particular market situation. You should analyze the market picture, trying to answer the question of who is trying to cheat and whom. And once you've found an answer, you can try to look for a trading opportunity.

If you're interested in this indicator and you want to know more about it, our Order Book guide will help you understand the analysis technique and displayed data interpretation.

What Kind of Data Does the Indicator Show?

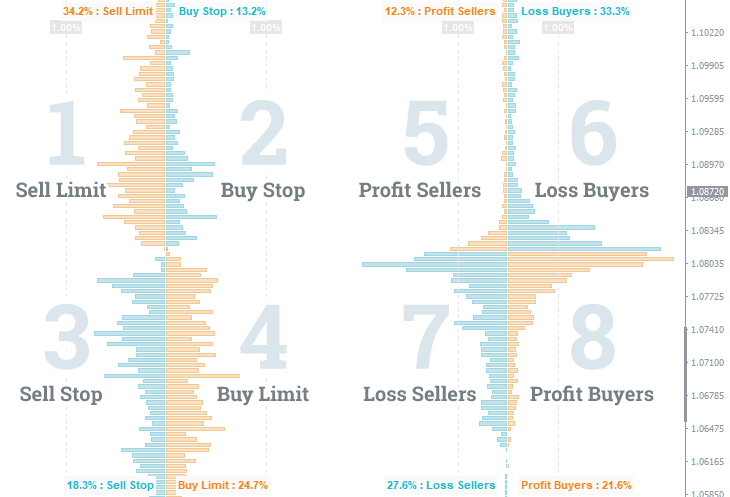

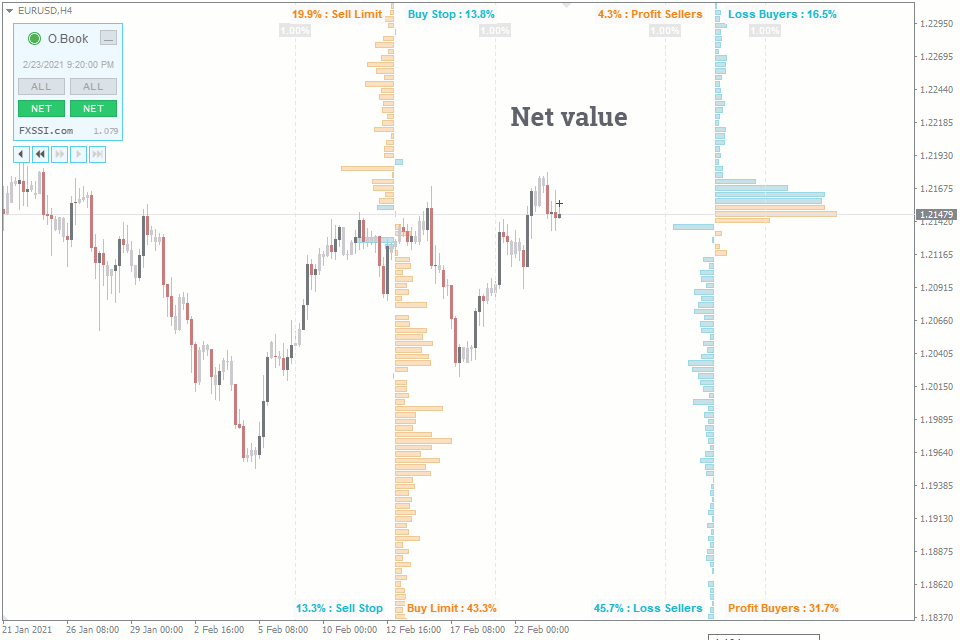

OrderBook is the visual representation of trading activity, namely, open trades, pending orders, and Stop orders.

At each price level, the trades are summed up and represented as a histogram. As a result, we get the following picture:

OrderBook - quadrants

The picture shows the extended order book that includes all types of pending orders as well as open trades.

The original concept of the order book meant that only the first and fourth squares (i.e., only Limit orders) were displayed.

You can read about the formation principles of this particular order book comprising only Limit orders in the article about the stock exchange order book.

Adding other types of orders and forming a two-sided order book like in our case, was possible thanks to the customer base of a particular broker.

The ordinary stock exchanges cannot provide a two-sided order book since they don’t have the required information.

Indicator Features

The indicator was developed by a team of experienced traders and programmers, so it’s not only a program for data transfer but also a handy and effective tool for analyzing financial markets.

Here are some of the OrderBook indicator features:

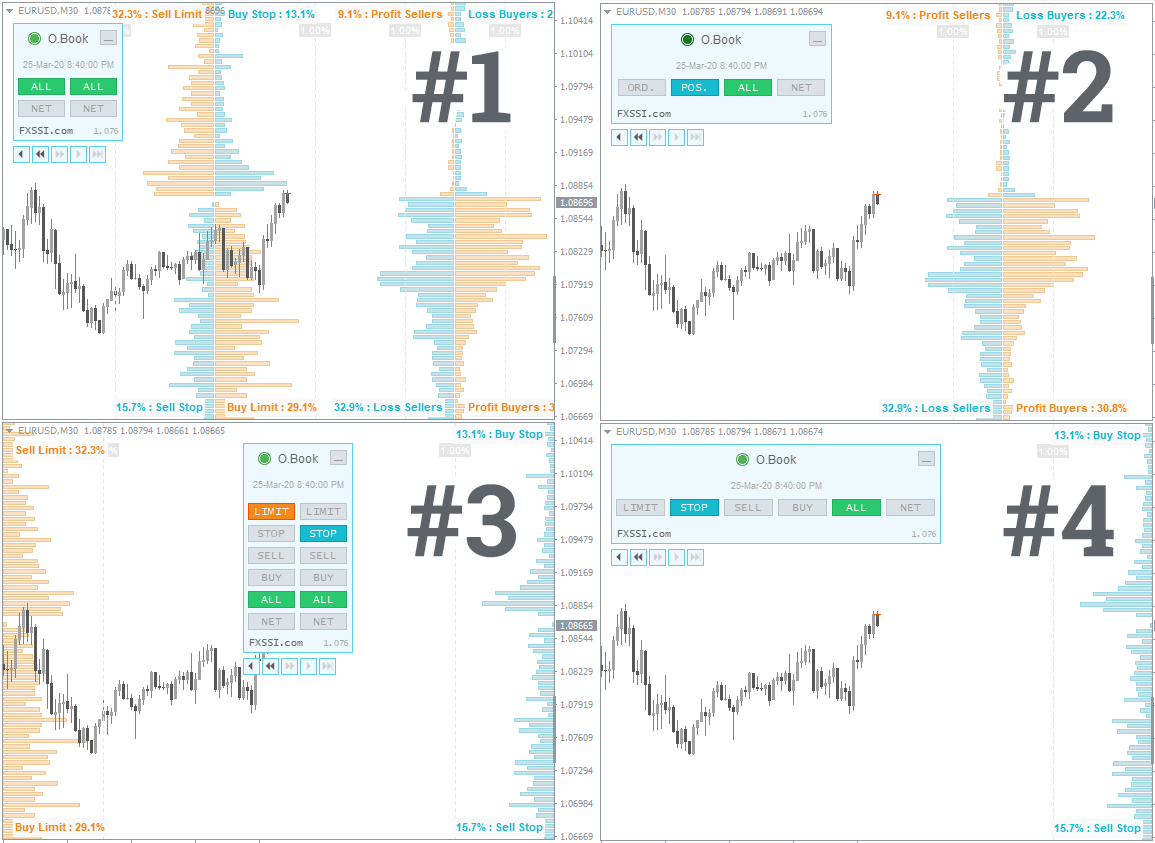

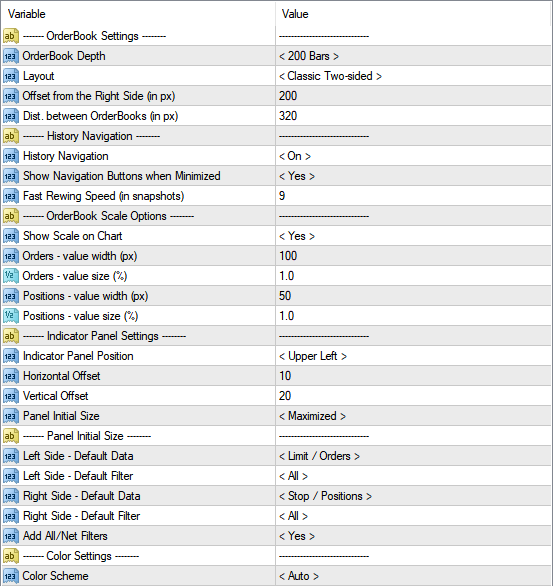

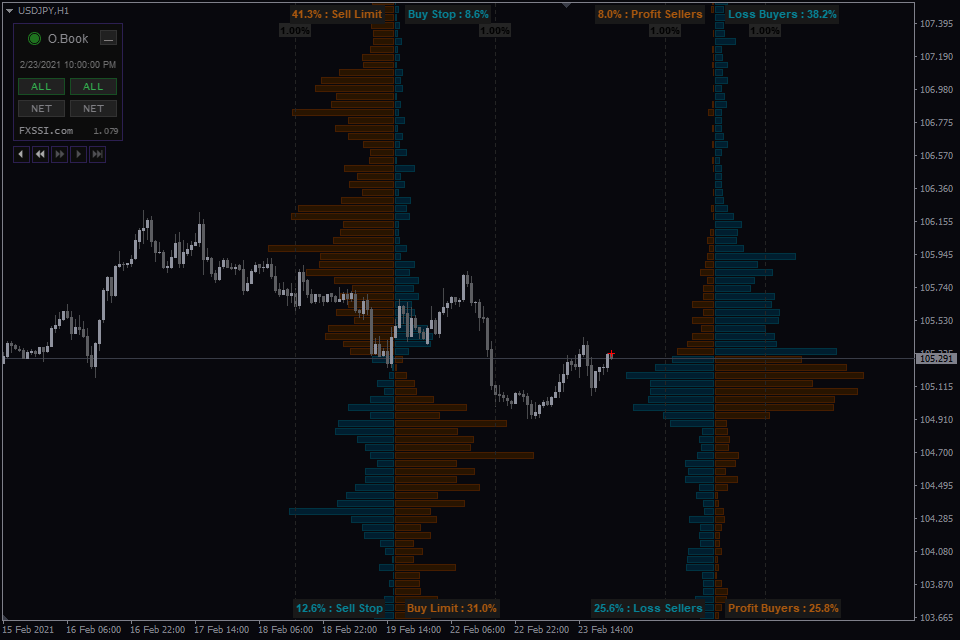

Cast time. The panel shows the time of the current cast. It’s actually the time when the data was last updated. If the label is blue, the history navigation mode is enabled.

History navigation. The indicator allows you to navigate the history of casts. The history depth depends on the selected subscription plan.

OderBook - Rewind History

Red cross mark. A cross mark on top of the candlestick chart indicates the price and time at which the Order Book cast was made. It is also used to rewind the history of casts.

Fast access to data. Switch between modes using the buttons on the indicator panel. You don't have to go to the indicator settings to change the type of the displayed data.

OrderBook - menu

The menu has the button to minimize the panel as well. You can set the minimized state of the panel as default in the indicator settings. It reduces the menu size in such a way as not to prevent you from making a candlestick analysis.

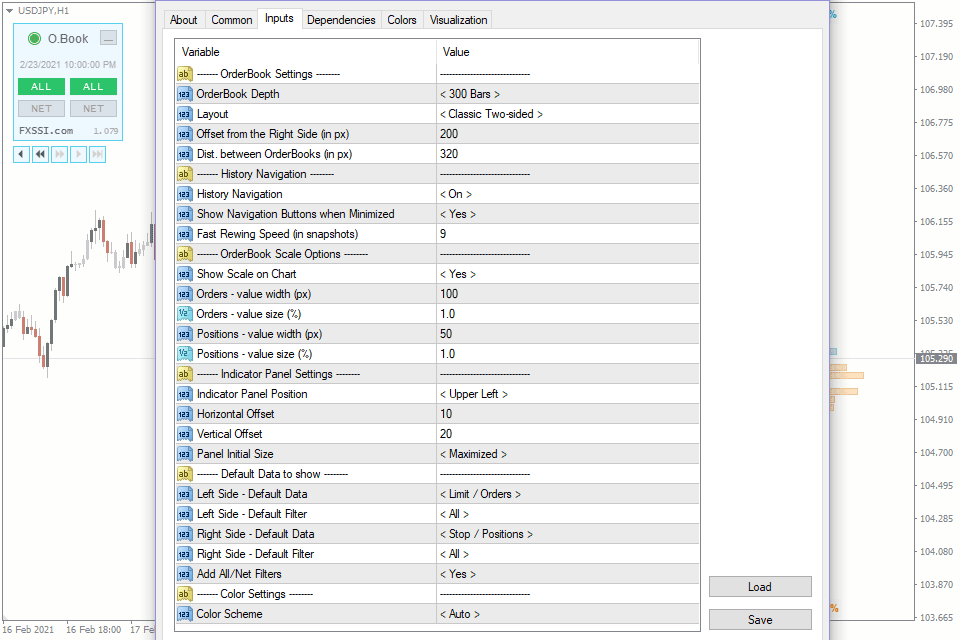

Four layouts. Simplified/classic, one-sided/two-sided. For more information, see the image below:

Order Book - display layouts

Auto settings. The indicator has a feature for the automatic detection of color scheme and time zone.

For your convenience, we have added the Automatic Indicators Update system. Now you only need to restart your terminal to get the latest versions. The indicator will inform you about it in a separate window.