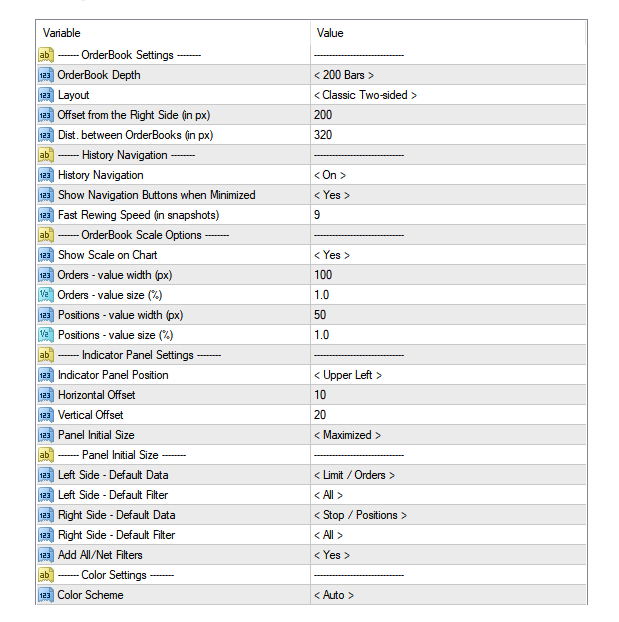

📸 Gallery

FXSSI.OrderBook

One of the most powerful tools for market sentiment analysis, this indicator plots two histograms that represent the Open Orders and Open Positions of market participants.

FXSSI.OrderBook - Overview

Analyze the market sentiment directly in the MT4 and MT5 terminal with the advanced OrderBook indicator.

The indicator will allow you to:

Identify the levels with the largest Stop Loss clusters;

Evaluate the chances of bulls or bears to develop the “attack”;

Distinguish false moves from the true ones;

And much more.

The OrderBook indicator will become an indispensable assistant for any trader who practices trading against the market majority.

Many of our clients find this indicator indispensable, making it a crucial part of their market analysis toolkit.

OrderBook Indicator

The OrderBook indicator displays open trades and pending orders of retail traders as a two-sided histogram. It is used for the comprehensive analysis of market sentiment for a particular financial instrument.

The OrderBook indicator consists of two parts:

Left-side order book, which displays all pending orders, including Take Profits and Stop Losses.

Right-side order book, which shows currently open trades of market participants.

The left order book further divide into quarters, each of which displays a specific order type, such as Sell Limit, Buy Stop, Profit Sellers or Loss Buyers, etc.

And the right histogram of OrderBook divides buyers and sellers into those in profit and those in loss.

By analyzing this kind of information and resorting to various patterns of the market crowd behavior, you can make complete trading decisions.

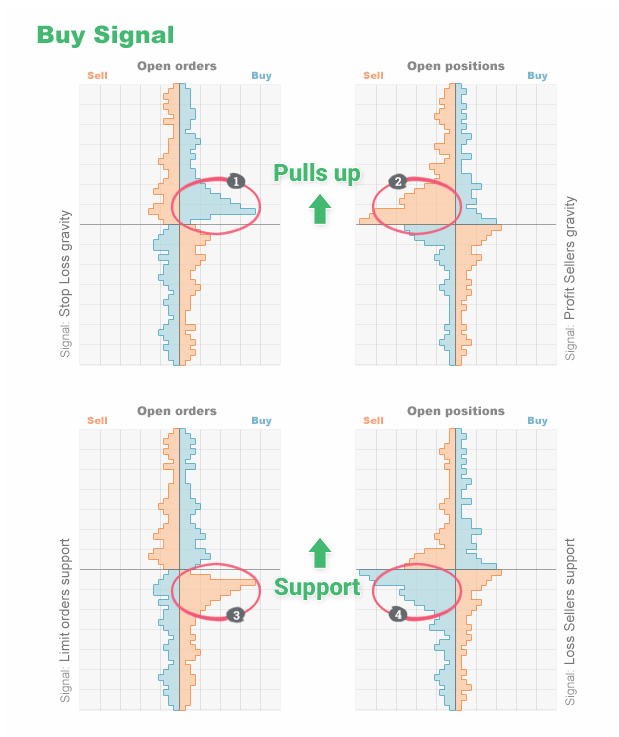

Trading With the OrderBook Indicator

First of all, you should understand that Order Book does not generate clear-cut signals like, for example, some indicators that draw arrows on the chart indicating Buy or Sell recommendations.

When it comes to the Order Book, the market analysis comes down to searching for existing or non-existing abnormal clusters among sellers and buyers.

The basic algorithm for the market analysis using the Order Book is as follows:

For Buy trades:

Clusters of buyers’ Stop Losses attract the price;

Dominant winning sellers pull the price up;

Clusters of Buy Limit orders act as support;

Dominant losing sellers push the price up.

For Sell trades:

Clusters of sellers’ Stop Losses attracts the price;

Dominant winning buyers pull the price down;

Clusters of Sell Limit orders act as resistance;

Dominant losing buyers push the price down.

However, this doesn’t mean that you should immediately open a Sell trade when you see, for example, a cluster of winning buyers.

We can guarantee that at first, you'll see things in the market that aren't really there. With practice, you'll learn to tell which signals are real and reliable.

Trading with the Order Book needs a bit more detailed analysis for each market situation. You should examine the market to figure out who might be trying to manipulate whom. Once you have an idea, you can then look for a trading opportunity.