📸 Gallery

FXSSI.StopLossClusters

Pro

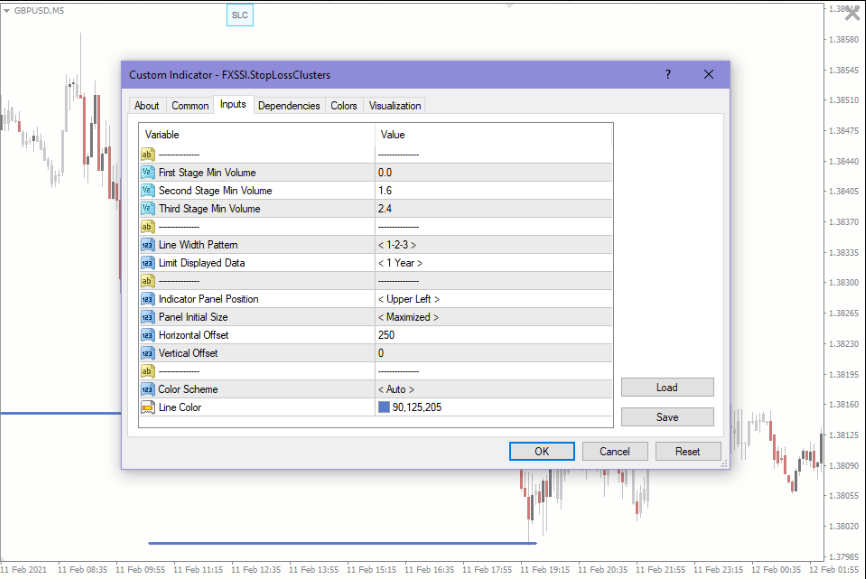

The indicator displays levels on the chart with the maximum volume of Stop Losses set by other market participants.

FXSSI.StopLossClusters - Overview

A beginner trader once thought:

“If only I knew where other traders set their Stop Losses, my trading performance would significantly improve.”

At the time, it was nothing more than a naive dream.

The trader couldn’t even imagine that today, we would have an opportunity of using such an indicator as FXSSI.StopLossClusters, in MT4 and MT5 terminals.

StopLossClusters Indicator

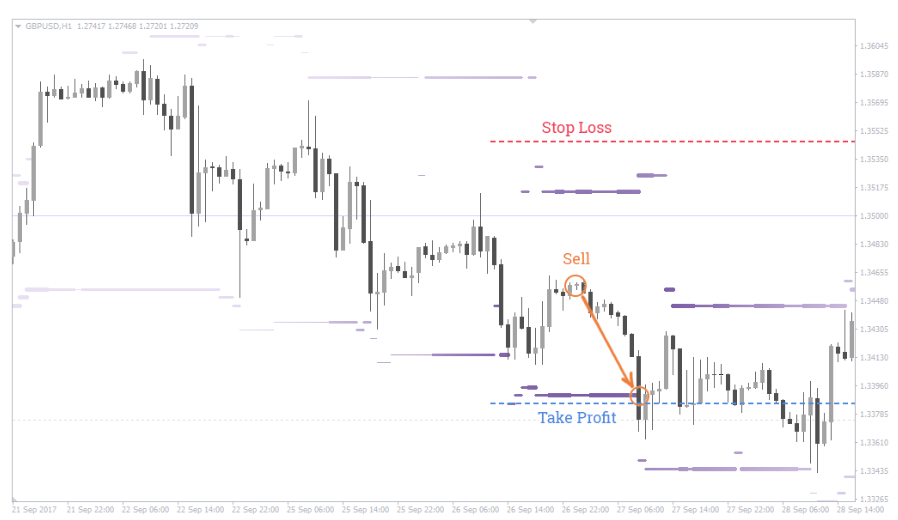

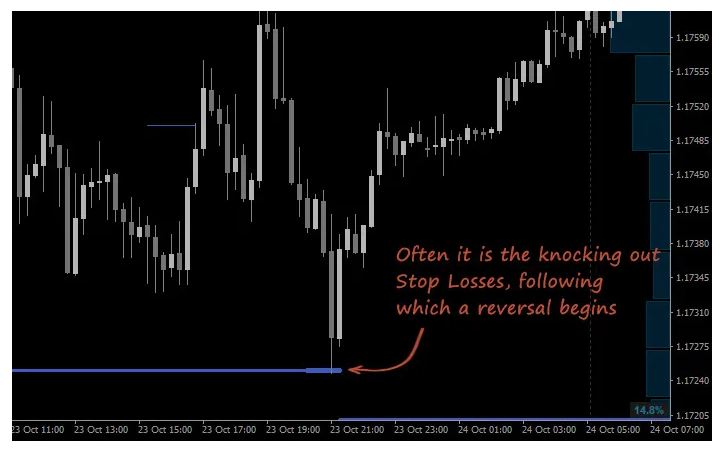

The Stop Loss Clusters (SLC) indicator shows where most market participants have placed Stop Losses for their trades. The largest accumulations of these orders – clusters – are displayed by the SLC indicator on the chart in the MT4/5 terminal.

Cluster (accumulation) implies a small range on the price scale of an asset, within which there is a significant number of Stop Losses set by other market participants.

Typically, the clusters form at local price lows and highs, or major support and resistance levels.

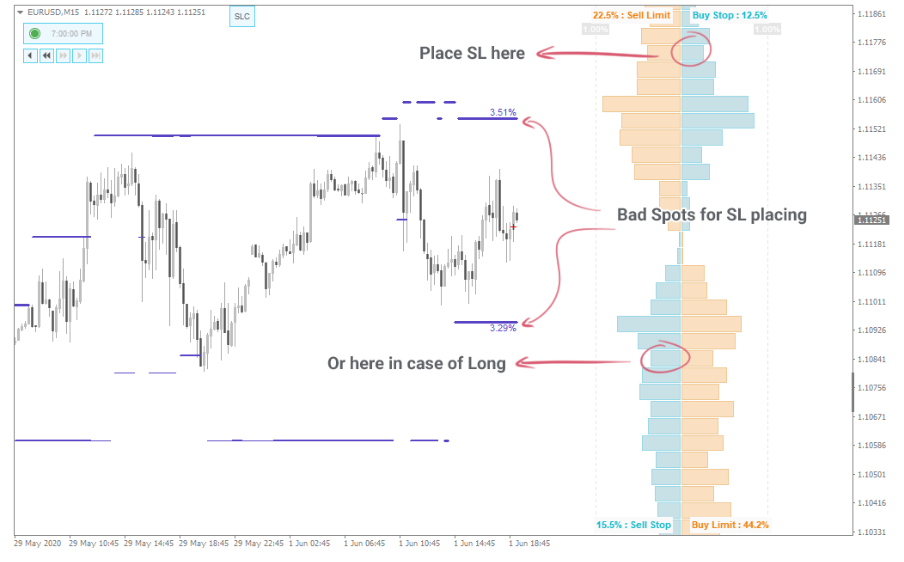

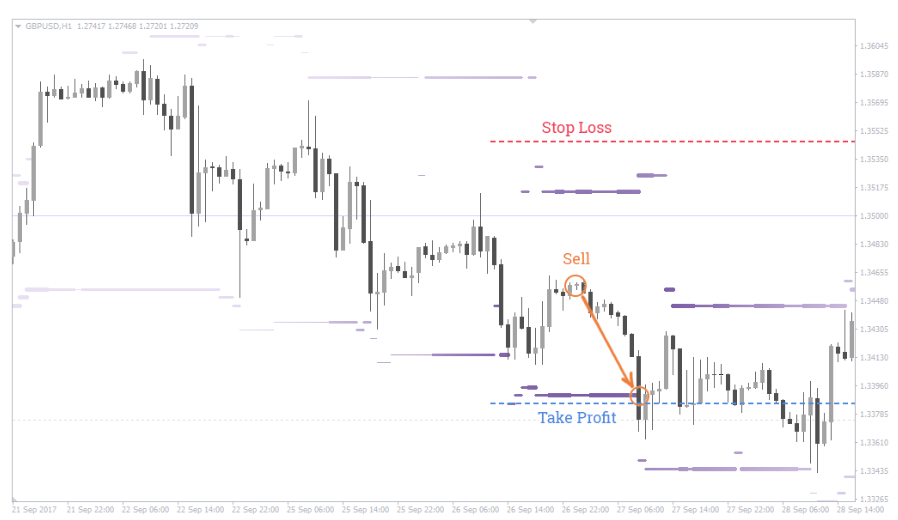

Out of all Stop Loss clusters, the SLC indicator displays only the two largest ones on the chart: one is above the current price, and the other is below it.

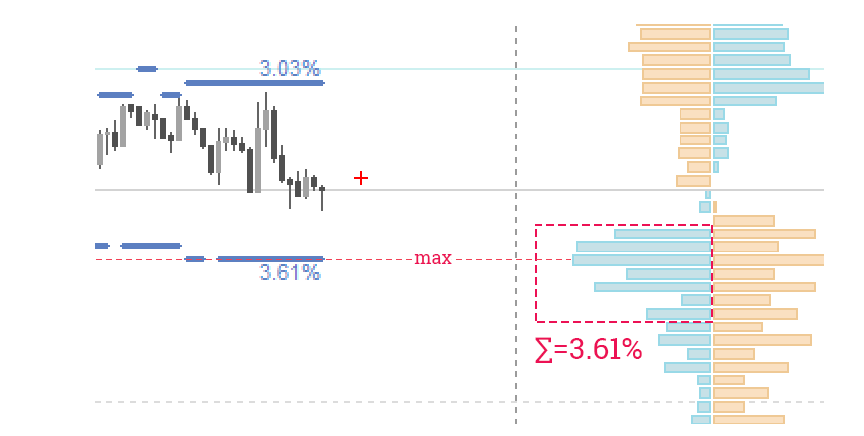

The larger the total cluster volume, the thicker will be the SLC indicator line displayed on the chart. By doing so, the indicator adds the third dimension (the cluster volume) to the chart, imitating a heat map.

Why it is important to know where Stop Losses of the market “crowd” are placed?

From the very beginning of their careers, every trader is always reminded of the importance of protective Stop orders. Indeed, trading without Stop Losses is considered very risky.

Following this recommendation, most traders set their Stop Losses using different approaches, and some of them even set Stop orders in a random place on the chart.

Despite the variety of Stop Loss setting techniques, eventually, their distribution will still be uneven. The reason is that traders are subject to the same behavioral tricks, also known as Psychological Traps.