📸 Gallery

Heiken Ashi Indicator

The Heiken Ashi Indicator is particularly used to ride a trend for a long time and to exit the market when the trends become weak.

The Japanese candlestick, one of the 3 charting systems used in forex, is the most common and preferred chart for technical analysis. The candlestick shows the open, high, low and close of each bar, and also indicates if the candle is bullish or bearish. Despite the fact that this chart is the most preferred, it is prone to numerous false signals due to a lot of noises in the market. The difficulty encountered using Japanese candlestick is corrected using the Heiken Ashi Indicator.

Foundation

The Heiken Ashi Indicator is a type of Japanese candlestick that takes the average of the 2 periods, thus making it smoother than the ordinary candlestick.

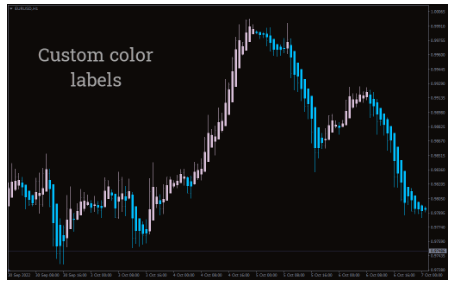

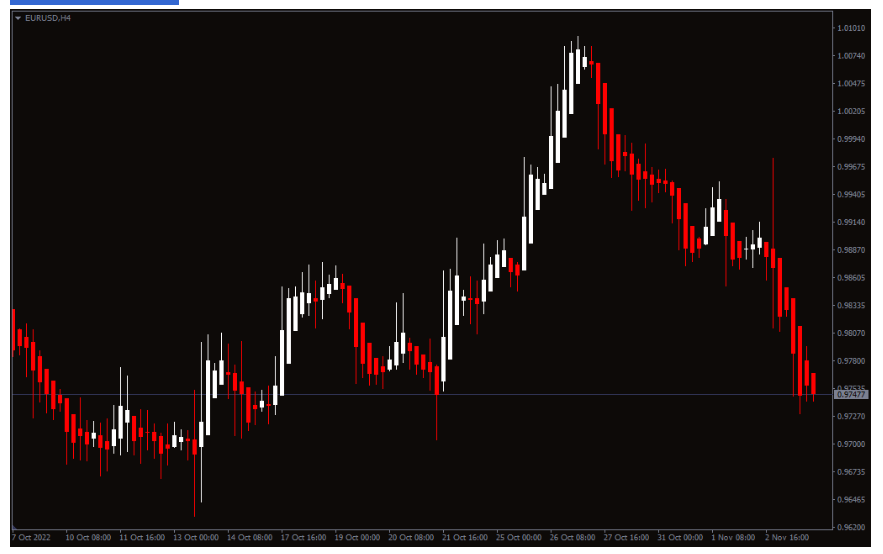

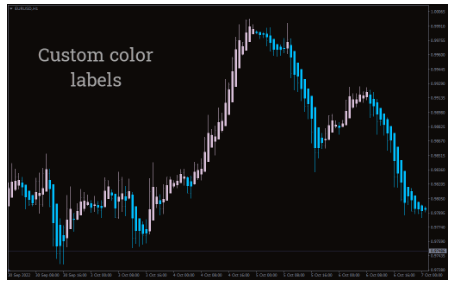

The diagrams below show the EUR/USD H4 of 2 different charts:

the Heiken Ashi Indicator

the ordinary Japanese candlestick

From the 2 diagrams above, the ordinary Japanese candlestick charts frequently change from red to green, which can make them difficult to elucidate.

Conversely, candles on the Heiken Ashi chart display more uniform colored candles, staying red in a downtrend and green in an uptrend.

Since the Indicator helps smooth out charts and filter out market noises, it is easier to spot a trend and trend reversals.

Spotting a trend and a trend reversal with this indicator helps traders to determine whether to hold a position or exit the market.

The Heiken Ashi Indicator is particularly used to ride a trend for a long time and to exit the market when the trends become weak.