Little Fighter Indicator – Complete Guide

Indicator Overview

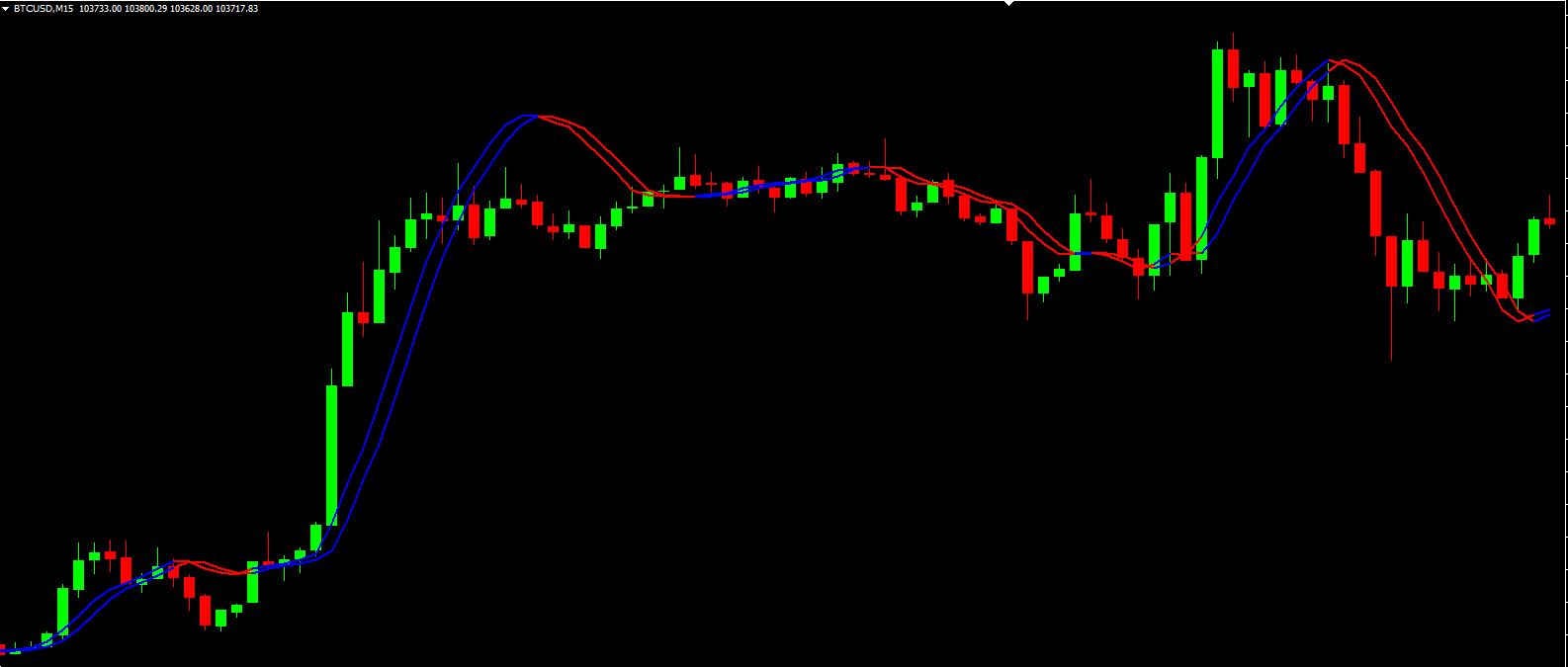

The Little Fighter is a custom MetaTrader 4 (MT4) indicator designed to help traders identify trend direction and potential reversals using a Linear Weighted Moving Average (LSMA) and a unique weighted price calculation. It plots two dynamic lines that change color based on their relative positions, providing clear visual signals for bullish and bearish conditions.

How the Little Fighter Indicator Works

The indicator uses two main components:

Weighted Trend Line (WTL) – A custom calculation that emphasizes recent price movements.

LSMA (Least Squares Moving Average) – A smoothed trend line that reduces lag compared to traditional moving averages.

Key Features:

Color-coded signals:

Blue lines = Bullish trend (WTL above LSMA)

Red lines = Bearish trend (WTL below LSMA)

Adjustable period settings for sensitivity tuning.

Smooth, lag-reduced calculations for better trend detection.

Indicator Settings & Parameters

Input Parameters:

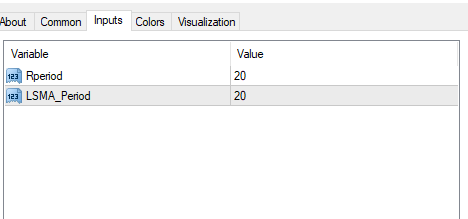

ParameterDescriptionDefault ValueRecommended Range

RperiodMain calculation period (weighted trend)2010-50 (shorter = more sensitive)

LSMA_PeriodSmoothing period for LSMA2010-30 (shorter = faster signals)

Visual Settings:

Red Lines: Indicate bearish momentum (WTL below LSMA).

Blue Lines: Indicate bullish momentum (WTL above LSMA).

Line Width: Set to 2 for clear visibility.

How to Use the Little Fighter Indicator

1. Trend Identification

Bullish Signal: When the blue lines are visible (WTL LSMA), consider buying or holding long positions.

Bearish Signal: When the red lines are visible (WTL LSMA), consider selling or holding short positions.

2. Trade Entry & Exit

Entry: Look for crossovers where the WTL crosses above/below the LSMA.

Exit: If the lines change color, it may signal a trend reversal.

Confirmation: Combine with support/resistance levels or other indicators (e.g., RSI, MACD) for stronger signals.

3. Best Timeframes & Markets

Works well on M15, H1, H4 timeframes for swing trading.

Effective in trending markets (less reliable in choppy conditions).

Slogan

"Small but Mighty – Let the Little Fighter Guide Your Trades to Victory!"

Pro Tips for Better Results

✅ Adjust Sensitivity:

Use shorter periods (10-15) for scalping.

Use longer periods (30-50) for swing trading.

✅ Avoid False Signals:

Wait for candle closes before acting on signals.

Combine with volume analysis for confirmation.

✅ Risk Management:

Always use stop-loss orders to protect against reversals.

Avoid trading solely based on this indicator—use it as part of a broader strategy.

Final Thoughts

The Little Fighter is a powerful yet simple trend-following tool. Its dynamic color changes make it easy to spot trend shifts, while its customizable settings allow traders to adapt it to different trading styles.

🚀 Best for:

Swing traders looking for trend confirmation.

Day traders who need quick visual cues.

Beginners who want a clean, easy-to-read indicator.