Lone Fighter Indicator - Comprehensive Guide

Indicator Overview

The Lone Fighter is a volatility-based trading indicator that uses ATR (Average True Range) to generate buy/sell signals. It's designed to help traders identify potential trend reversals with clear arrow signals on the chart.

How It Works

The indicator calculates a trailing stop loss based on the ATR value multiplied by a key coefficient (m). When price crosses above this trailing stop, it generates a buy signal (up arrow). When price crosses below, it generates a sell signal (down arrow).

Key Features:

Multi-timeframe capability (can show signals from higher timeframes)

Customizable ATR period and multiplier

Option to use Heiken Ashi candles for signal generation

Multiple notification options (desktop, email, push)

Adjustable arrow display settings

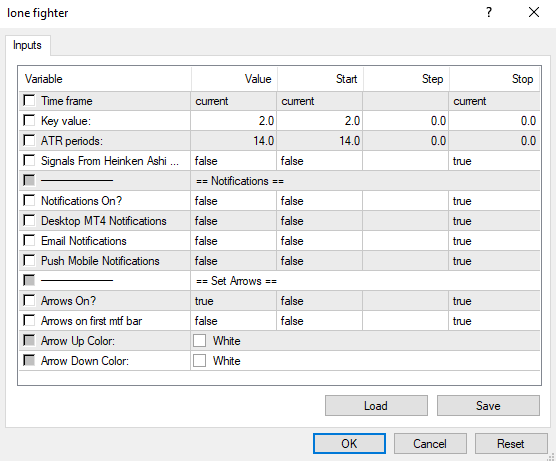

Indicator Settings

Main Parameters:

TimeFrame: Select the timeframe for analysis (default: current chart timeframe)

m (Key value): ATR multiplier that determines stop distance (default: 2)

atrPeriods: Number of periods for ATR calculation (default: 14)

h: Signals from Heiken Ashi candles (default: false)

Notification Settings:

notifications: Enable/disable all notifications

desktop_notifications: MT4 desktop alerts

email_notifications: Email alerts

push_notifications: Mobile push notifications

Arrow Display Settings:

ArrowsOn: Show/hide arrows on chart

inpArrowsOnFirst: Show arrows on first multi-timeframe bar

ArrowUpClr/ArrowDnClr: Customize arrow colors

How to Use the Indicator

Signal Interpretation:

Blue up arrow = Buy signal (price crossed above ATR trailing stop)

Red down arrow = Sell signal (price crossed below ATR trailing stop)

Trading Strategy:

Enter long when up arrow appears, with stop loss below recent swing low

Enter short when down arrow appears, with stop loss above recent swing high

Adjust the 'm' parameter to make signals more/less sensitive

Multi-Timeframe Analysis:

Set higher timeframes to see higher timeframe signals on your chart

Helps identify confluence between timeframes

Slogan

"Fight the markets alone no more - let the Lone Fighter guide your trades to victory!"

Tips for Best Results

Combine with other indicators for confirmation

Use higher 'm' values (3-4) for longer-term trades

Lower 'm' values (1-2) work better for shorter timeframes

Adjust ATR period based on market volatility (shorter for more sensitive signals)

The Lone Fighter works exceptionally well in trending markets but may produce whipsaws during ranging conditions. Always practice proper risk management when trading with any indicator.