📸 Gallery

Lucky Reversal Indicator

With this lucky reversal indicator, you can catch major trend reversals and still follow new trends. Find out how to do it in our article.

Trend reversal in the Forex market happens all the time. As long as there are trends, there will always be reversals. Many tools and strategies for trend and trend reversal trading are based on this simple concept. Now the only question is how can a trader use the right tools to catch reversals and trade with the trends. The Lucky reversal indicator is one of many reversal indicators.

But it has some unique features that make it different from other forex trend reversal indicators.

What is a good reversal indicator

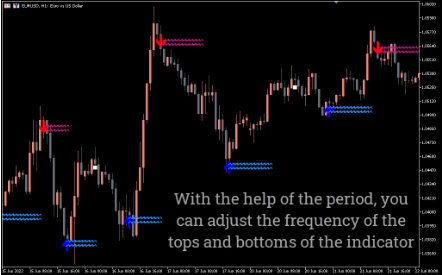

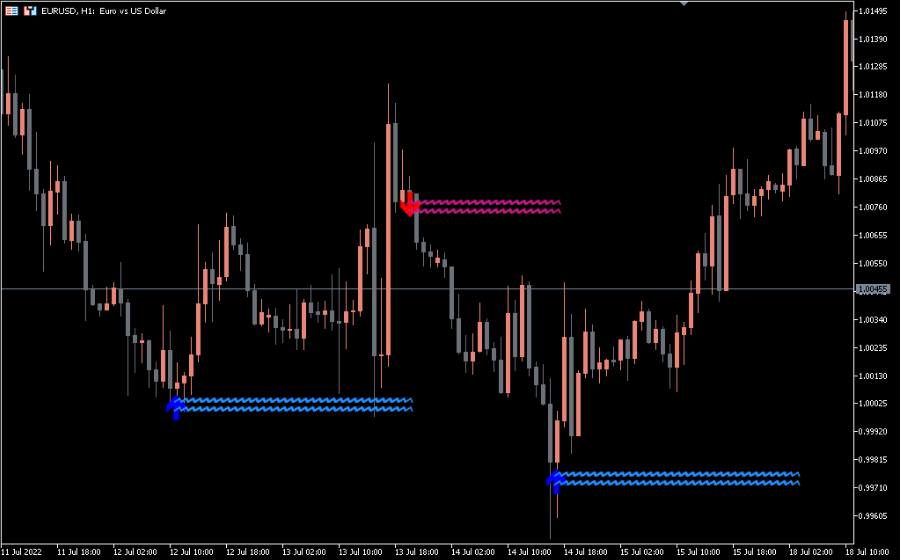

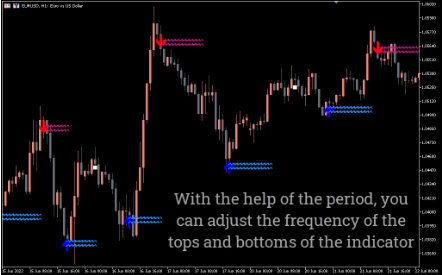

The Lucky reversal indicator lives up to its name: it tells you when the trend has changed from up to down or from down to up. It gives signals in the form of blue and red arrows, each of which is followed by wavy horizontal lines. The blue arrow marks the start of an uptrend, while the red arrow indicates a market reversal to a downtrend.

The major flaw of the Lucky indicator

The successful reversal indicator is different from many other trend reversal indicators. The reason is that this is a lagging indicator, so a trader is unlikely to be able to trade with it on reversal breakouts.

Many traders have become frustrated trying to use the indicator to detect the start of a reversal, and you can’t blame them for trying. If you backtest the indicator, you will find that bullish and bearish signals are right at the lowest or highest reversal points of major trend reversals. See an example in the image below. You will notice that the price will reverse as soon as the arrow appears.

However, when testing the indicator in a live market, you will find that bullish or bearish signals only appear after the market has completed a reversal. The reversal arrow appears on the chart only after the reversal is confirmed. This shows that the Lucky reversal indicator is lagging behind.