📸 Gallery

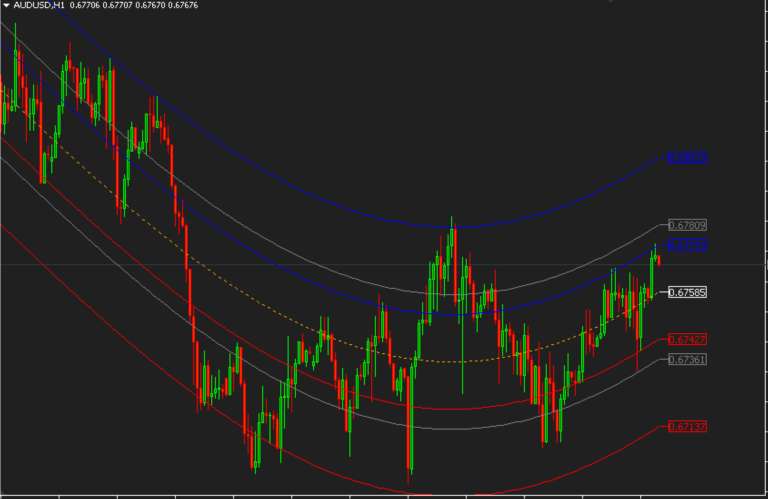

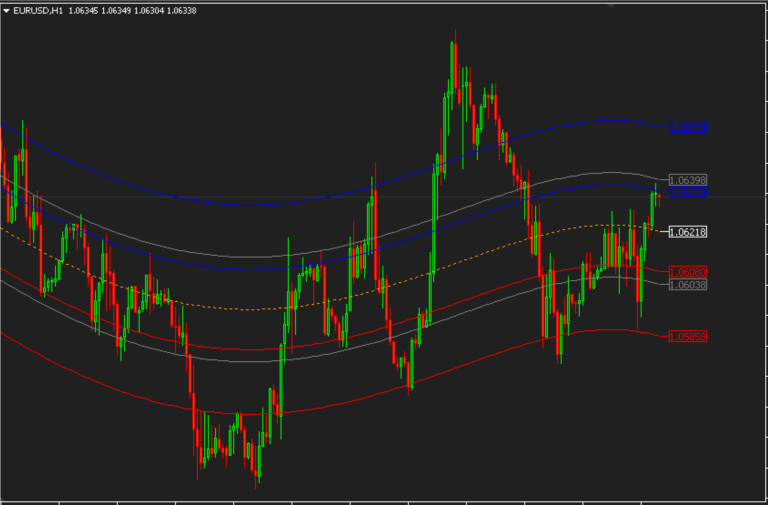

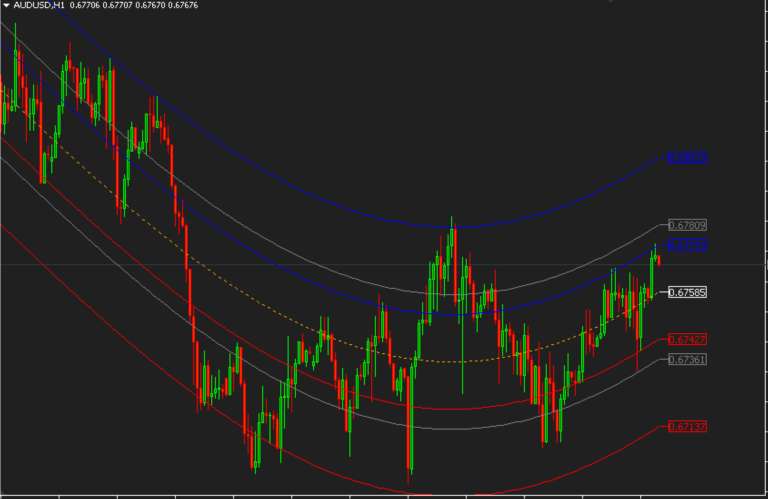

Mean Reversion Indicator

Technical analysis uses mean reversion to describe the belief that a stock will eventually return to its average or mean price. Forex traders use mean reversion as a trading strategy and technical indicator.

The theory of mean reversion states that prices fluctuate around a center of gravity (average price) over time. If a price moves away from or close to its average price, it will eventually return to the average price. This gives traders the opportunity to sell high and buy low.

One can use mean reversion, which is a technical indicator that can be used to identify overbought and oversold stocks and prepare for a reversal. While there is no way to guarantee that prices will return to their average level every time, mean reversion is an effective tool that forex traders have used to consistently generate profits.

SMA reversion buy/sell signals

Mean Reversion Indicator

Averaging is a forex trading strategy and technical analysis that attempts to predict when prices are likely to return to their average or mean price levels, known as averaging.