Military Rule Indicator - Comprehensive Guide

🏆 Motto:

"Trade with discipline – let the Military Rule enforce your strategy!"

📌 Overview

The Military Rule indicator is a dynamic stop-loss and reversal system designed to help traders manage risk and identify potential trend reversals. It combines ATR-based volatility measurements with price action to plot trailing stops and generate entry signals.

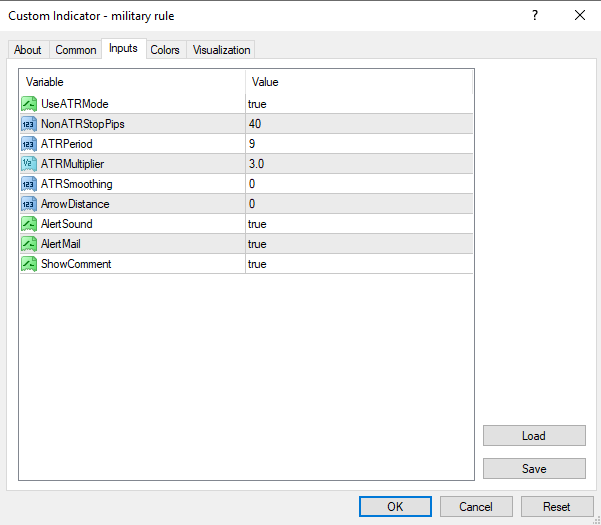

🔧 Indicator Settings

Input Parameters:

UseATRMode (Default: true) – Switches between ATR-based or fixed-pip stop calculation.

NonATRStopPips (Default: 40) – Fixed stop distance (in pips) when ATR mode is off.

ATRPeriod (Default: 9) – Lookback period for ATR calculation.

ATRMultiplier (Default: 3.0) – Multiplier applied to ATR for stop distance.

ATRSmoothing (Default: 0) – Smoothing factor for ATR (auto-adjusted to 1 if ≤0).

ArrowDistance (Default: 0) – Vertical offset for signal arrows.

Alerts:

AlertSound – Plays sound on signals.

AlertMail – Sends email alerts.

ShowComment – Displays on-chart info.

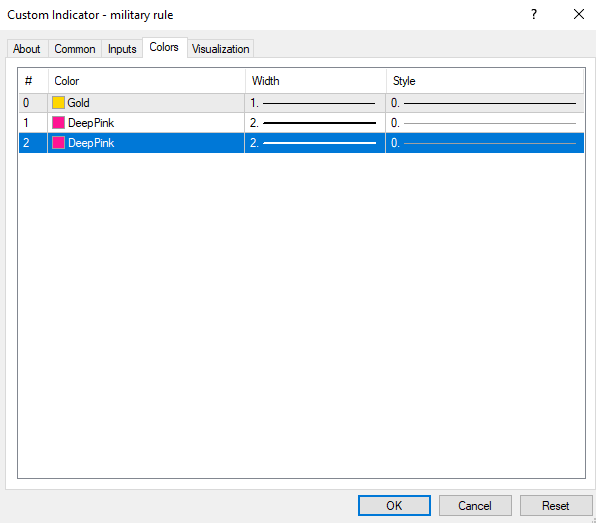

Visual Elements:

Gold Line: Dynamic trailing stop level.

Up Arrow (Gold): Bullish reversal signal.

Down Arrow (DeepPink): Bearish reversal signal.

📊 How It Works

Core Algorithm:

Stop Calculation:

In ATR Mode: Stop distance = ATR(ATRPeriod) × ATRMultiplier.

In Manual Mode: Stop distance = NonATRStopPips in pips.

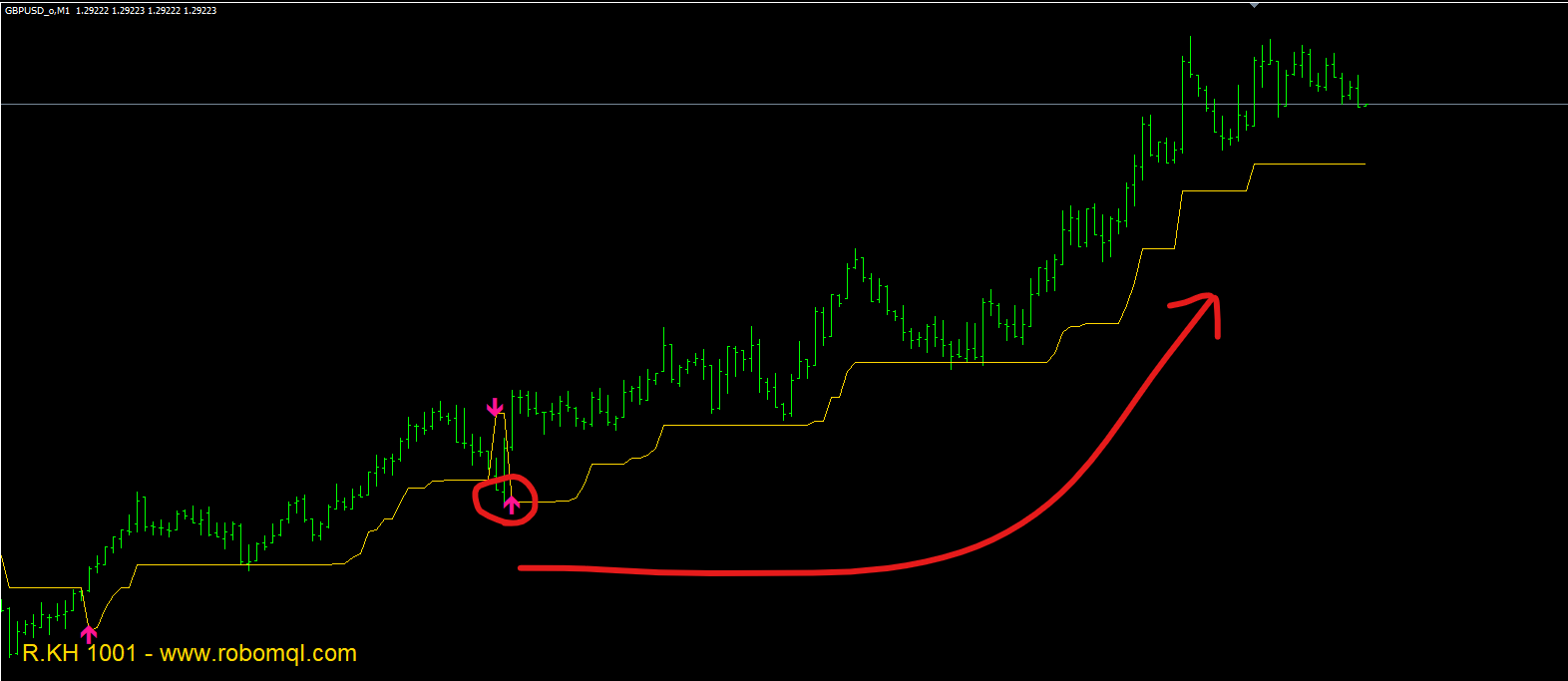

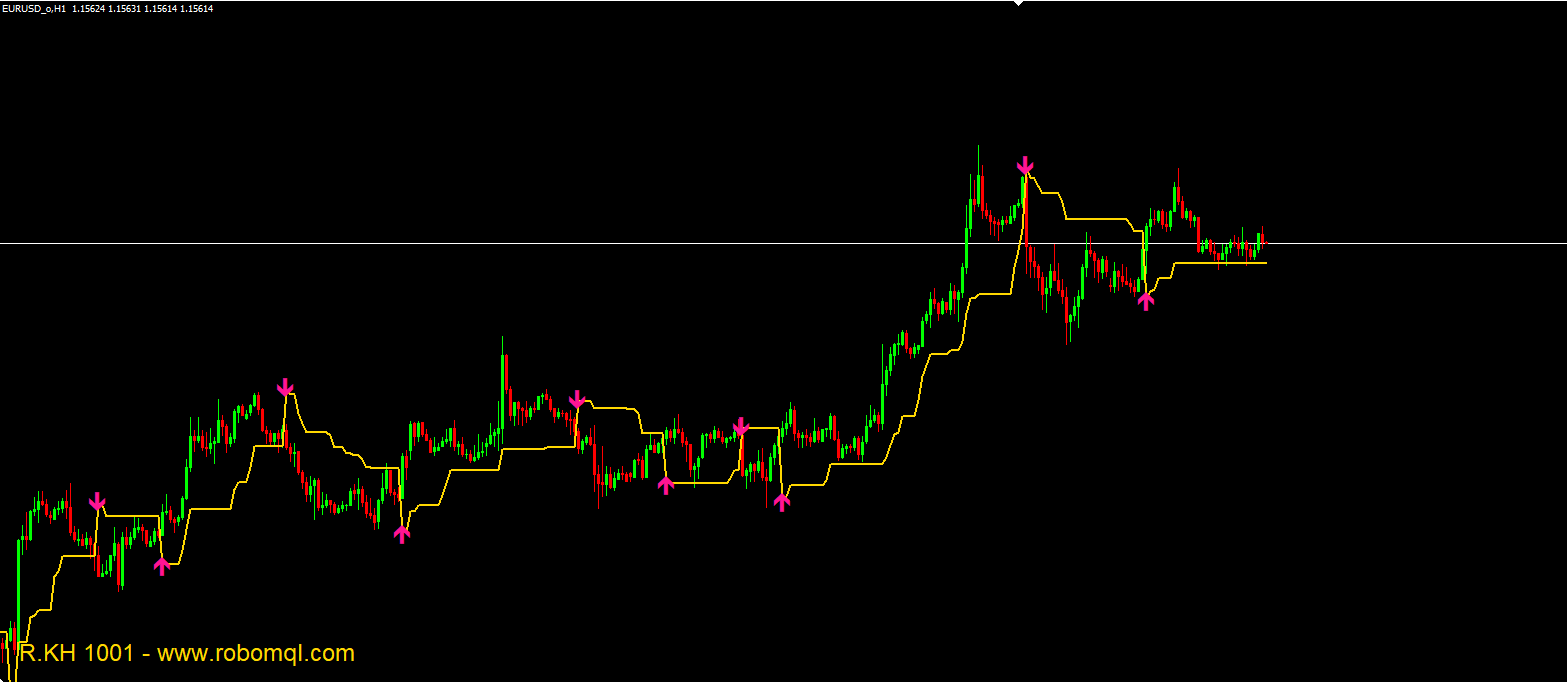

Trailing Logic:

The stop level only moves in the trend direction, locking in profits.

When price closes beyond the stop:

A reversal arrow appears (up for bullish, down for bearish).

The stop flips to the opposite side.

Signal Generation:

Buy Signal: Price closes above stop → Gold up arrow.

Sell Signal: Price closes below stop → DeepPink down arrow.

🎯 Trading Strategy Suggestions

Trend-Following Approach:

Enter long on up arrows in an uptrend (confirmed by higher highs/lows).

Enter short on down arrows in a downtrend (confirmed by lower highs/lows).

Reversal Strategy:

Use arrows as potential reversal points, especially at key S/R levels.

Best Practices:

Higher Timeframes (H4/D1) reduce false signals.

Combine with RSI/MACD for confirmation.

Adjust ATRMultiplier based on volatility (increase for choppy markets).

🔍 Additional Notes

Alerts Feature: Can notify via sound/email (great for multi-chart monitoring).

Self-Adjusting: Stops widen/narrow with market volatility in ATR mode.

Low Lag: Reacts faster than traditional moving averages.

📜 Developer & Source

Developer: R.KH 1001

Source: RoboMQL

🚀 Command your trades like a general – discipline wins the trading war! 🚀