Point Weapon Indicator - Complete Explanation

Overview

The Point Weapon indicator is a volatility-based trend-following tool that identifies potential reversal points using:

Adaptive channel breakout logic

ATR (Average True Range) for dynamic thresholds

Price action filtering

It displays blue up arrows for bullish signals and red down arrows for bearish signals when price breaks through its adaptive channels.

Key Components

1. Visual Elements

ElementDescriptionColorArrow Code

Blue Up ArrowBullish reversal signal (price breaks lower boundary)Blue233

Red Down ArrowBearish reversal signal (price breaks upper boundary)Red234

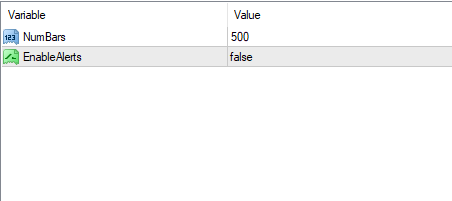

2. Input Parameters

ParameterDescriptionDefault

NumBarsNumber of bars to calculate (backperiod)500

EnableAlertsWhether to enable trading alertsfalse

How It Works

1. Core Calculation Logic

The indicator uses a weighted moving average of True Range (ATR) to create dynamic price channels:

A) True Range Calculation

mql4

TR = spread + High[Shift] - Low[Shift];

TR = MathMax(TR, MathAbs(spread + High[Shift] - Close[Shift+1]));

TR = MathMax(TR, MathAbs(Low[Shift] - Close[Shift+1]));

B) Weighted ATR Calculation

Uses a 7-period weighted moving average of TR values.

Applies decreasing weights (7,6,5,...,1) to give more importance to recent volatility.

C) Channel Width Adjustment

mql4

widcha = cecf * ATR; // cecf = 0.7 (volatility multiplier)

2. Trend Detection & Signal Generation

A) Bullish Signals (Blue Arrows)

Triggered when:

Price was in a downtrend (river=False).

Price breaks above Emaxtra + widcha (upper channel).

Plots arrow at Low[Shift] - (ATR * 2/3).

B) Bearish Signals (Red Arrows)

Triggered when:

Price was in an uptrend (river=True).

Price breaks below Emaxtra - widcha (lower channel).

Plots arrow at High[Shift] + (ATR * 2/3) + spread.

C) Additional Filtering

Signals are invalidated if:

Bullish arrow appears below a 288-period MA.

Bearish arrow appears above a 288-period MA.

Trading Applications

1. Trend Reversal Signals

Buy when a blue arrow appears (after a downtrend break).

Sell when a red arrow appears (after an uptrend break).

2. Volatility-Based Stops

The ATR-based channel width adapts to market conditions:

Wider channels in high volatility → fewer false signals.

Narrower channels in low volatility → earlier reversals.

3. Best Used In

✔ Trending markets (works as a pullback entry system).

✔ Breakout trading (captures early reversals).

Alert System (If Enabled)

Can trigger pop-up, email, or push alerts when:

A new blue arrow (buy signal) forms.

A new red arrow (sell signal) forms.

Advantages

✅ Self-adjusting to market volatility.

✅ Clear visual signals (arrows).

✅ Reduces false signals with MA filtering.

Limitations

❌ Repaints (since it recalculates on each bar).

❌ Not ideal for ranging markets (best in trends).

Conclusion

The Point Weapon indicator is a powerful trend-following tool that:

✔ Identifies high-probability reversals using ATR channels.

✔ Provides clear entry signals (arrows).

✔ Adapts to changing volatility.