Power Flight Indicator - Professional Trading System

Indicator Overview

The Power Flight is an advanced MACD-Bollinger Bands hybrid indicator that combines:

Dual moving average convergence (MACD)

Bollinger Bands volatility channels

Multi-timeframe capability

Clear visual trend signals

Core Trading Logic

Key Components:

Enhanced MACD System:

Fast EMA (default 12)

Slow EMA (default 26)

Signal line (default 10-period EMA)

Bollinger Bands Adaptation:

Standard deviation bands around MACD signal line

Adjustable StdDev parameter (default 1.0)

Signal Generation:

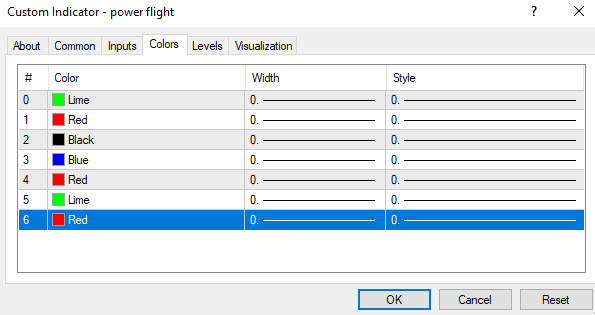

Lime Up Arrows: Strong bullish momentum signals

Red Down Arrows: Strong bearish momentum signals

Dot markers for trend direction

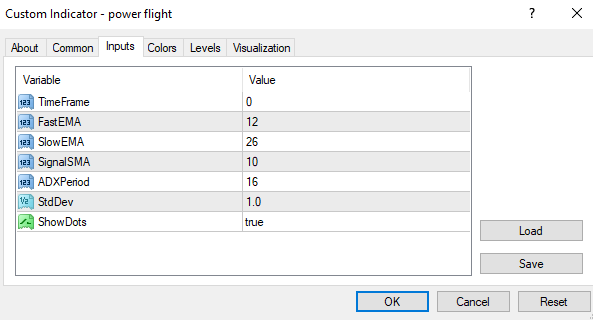

Optimal Settings

ParameterDescriptionRecommended Values

TimeFrameAnalysis timeframe0 (current) or higher timeframe

FastEMAFast EMA period12 (default) or 8 for faster signals

SlowEMASlow EMA period26 (default) or 21 for tighter MACD

SignalSMASignal line period10 (default) or 5 for more sensitivity

ADXPeriodTrend strength filter14-16 (default)

StdDevBollinger Band width1.0-2.0 (higher for more volatile markets)

ShowDotsDisplay trend dotsTrue for visual confirmation

Professional Trading Strategy

Best Timeframe Applications:

M15-H1: Ideal for day trading

H4-D1: Perfect for swing trading

W1-MN1: Excellent for position trading

Trading Signals:

Long Entries:

When lime arrow appears below MACD line

Confirm MACD above signal line

Price above key support level

Stop loss below recent swing low

Short Entries:

When red arrow appears above MACD line

Confirm MACD below signal line

Price below key resistance level

Stop loss above recent swing high

Advanced Techniques:

Trade bounces at Bollinger Band extremes

Watch for MACD/signal line crossovers

Combine with price action confirmation

Use higher timeframe signals for direction bias

Slogan

"Soar Above the Markets with Precision - Let Power Flight Guide Your Trades to New Heights!"

Pro Trading Tips

Multi-Timeframe Analysis:

Set TimeFrame=240 for H4 confirmation

Use weekly charts for overall trend

Risk Management:

Start with StdDev=1.5 for balanced signals

Adjust between 1.0 (aggressive) and 2.0 (conservative)

Use 1% risk per trade

Signal Enhancement:

Wait for candle close confirmation

Combine with RSI (30/70 levels)

Filter with 200 EMA trend direction

Indicator Strengths

✓ Clear visual trend identification

✓ Combines momentum and volatility analysis

✓ Works across all liquid markets

✓ Customizable for various trading styles

Performance Tips

• For forex: EUR/USD, GBP/USD, USD/JPY

• For stocks: Liquid large-caps (AAPL, MSFT)

• For crypto: BTC/USD, ETH/USD

Recommended Pairings:

Volume indicator for confirmation

Support/resistance levels

Price action patterns

Would you like me to develop any of these enhancements?

Alert system for key signals

Multi-timeframe dashboard version

Automated trade execution EA

Advanced divergence detection