Precision Scalper MT4

Description of Precision Scalper

The EA is centered on a unique observation: movements between AUD, CAD, and NZD pairs tend to revert to the originating direction after significant fluctuations. This characteristic underpins the grid-martingale methodology, where the system can accumulate points during pronounced market movements.

Key Attributes:

Operates exclusively on AUDCAD, AUDNZD, and NZDCAD.

Designed for use on the MT5 platform.

Built to function with minimal parameters and optimized for ease of use.

By streamlining its scope to these three pairs and integrating adaptive lot-sizing methods, the EA positions itself as an accessible yet sophisticated trading solution.

See also Tony Manso Forex - Take Your Forex Trading To The Next Level

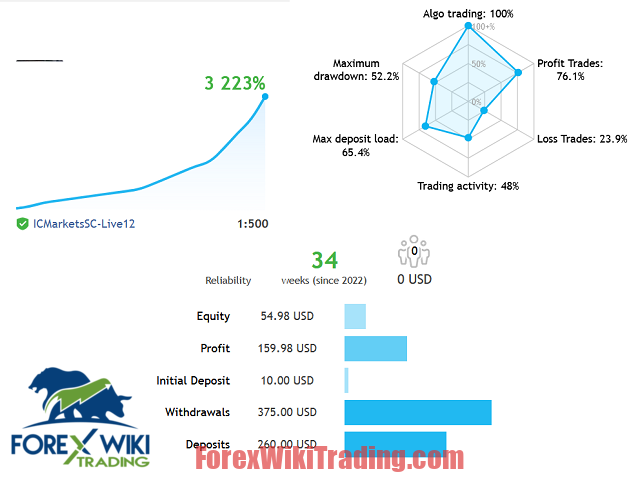

Results:

Precision Scalper MT4

Precision Scalper has shown solid performance by exploiting the reversion tendencies of AUDCAD, AUDNZD, and NZDCAD pairs.

Returns: Historical results and real account monitoring indicate potential annual returns ranging from 20% to 120%, depending on the risk settings.

Drawdown Management: The system’s adaptive strategies help limit losses during recovery cycles.

Stability: Consistent performance is observed in moderately volatile conditions, where the system effectively closes grid trades.

Adaptability: Best performance is seen with ECN brokers to minimize spreads and slippage, along with well-managed risk settings.

Advantages of Precision Scalper

Real Account Monitoring

Users can monitor live trading results, offering transparency and confidence in its performance.

Cost-Effectiveness

Compared to other grid-martingale systems, it is considerably more affordable, making it attractive to both novice and experienced traders.

Mini Account Compatibility

The EA can operate with accounts as small as $1, offering unparalleled accessibility to traders with limited starting capital.

Ease of Use

The system avoids overly complicated parameters, focusing on an intuitive user experience.

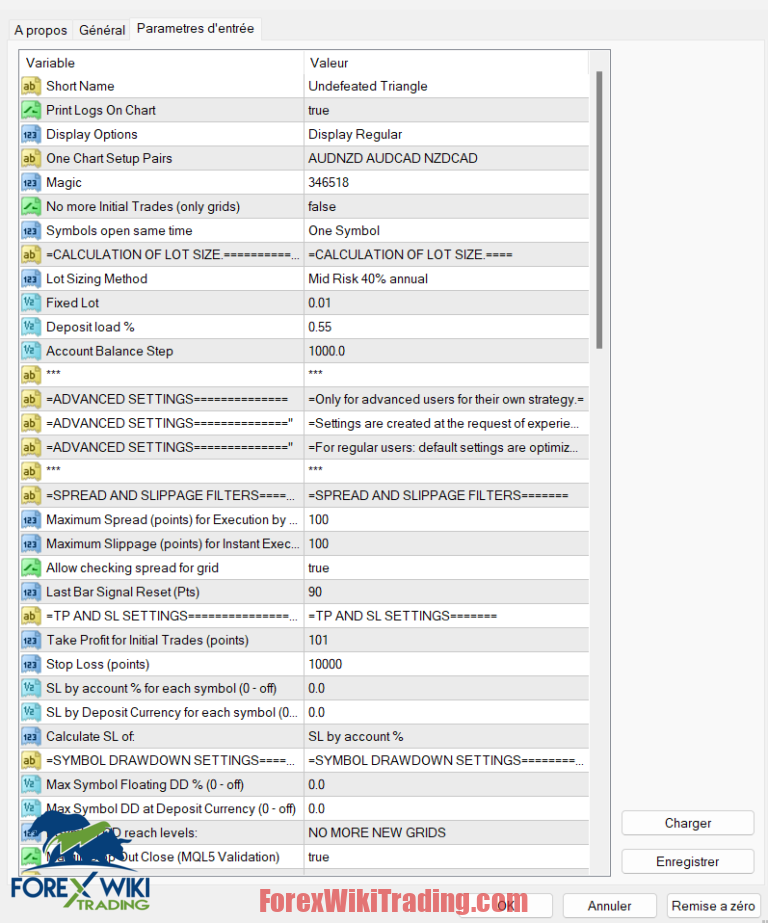

Customizable Settings

Short name customization for journal tracking.

Adjustable display for 4K monitors.

Configurable lot-sizing methods tailored to individual risk tolerance.

Scalability Across Account Sizes

Adaptive lot-sizing methods ensure compatibility with accounts of various equity sizes and leverage conditions.

Parameters Overview

Short Name and Logging Features

Easily customize journal entries for streamlined analysis.

Enable or disable an on-chart info panel.

Trading Pair Configuration

Specify supported pairs with suffixes (e.g., AUDCAD.a).

Lot Sizing Methods

Fixed Lot: Fixed size for all initial trades.

Risk-Based Options: Tailored to generate annual incomes ranging from 20% to 120%, with additional “Maxed Risk” settings for aggressive strategies.

Deposit Load %: Custom lot size determined by account equity and margin requirements.

Other Parameters

Symbols open simultaneously: Limits the number of active trades to reduce risk.

No more initial trades: Ensures only grid trades are initiated after the initial cycle.

Leverage and Risk Management

With low leverage accounts (1:30), using conservative settings (e.g., “Low Risk” at 20% annual) is advised for small accounts to avoid free margin issues. For higher leverage accounts (1:100+), more aggressive settings may be used, but caution is still necessary.

See also Smart Money Concepts EA MT4

Advantages vs. Disadvantages

Advantages

Profit Potential: The grid-martingale strategy can yield substantial returns if market conditions align.

Versatility: Can adapt to various account sizes and leverage conditions.

User-Friendly: Simplified setup and minimal ongoing management.

Affordable Entry: Low cost and compatibility with mini accounts open the door for new traders.

Disadvantages

Risk of Grid-Martingale Systems:

High drawdowns can occur during prolonged trends without reversals.

Requires careful risk management to avoid account depletion.

Broker Dependency:

Performance can suffer due to high spreads or slippage.

Continuous Monitoring:

The EA must run uninterrupted, necessitating the use of a VPS for many users.

Learning Curve:

While easy to use, novice traders may struggle to fully understand the underlying risk management principles.

Conclusion

Precision Scalper stands out in the crowded field of forex trading tools due to its targeted approach, affordability, and adaptability. By exploiting the unique dynamics of AUDCAD, AUDNZD, and NZDCAD, it provides an innovative solution for traders seeking to maximize opportunities within a defined niche.