Comprehensive Analysis of the "RED MAN" Indicator (MQL4)

This custom indicator, named "RED MAN", is a sophisticated trend-following oscillator that combines price action filtering, cycle analysis, and momentum detection to generate trading signals. Below is a detailed breakdown of its structure, logic, and practical applications.

1. General Overview

Indicator Name: RED MAN

Type: Separate window oscillator (-1.0 to +1.0 range)

Primary Purpose: Identifies trend reversals, momentum shifts, and cyclical patterns using adaptive filtering.

Key Features:

Price Action Filtering (SMMA-based)

Cycle Strength Detection (Major/Minor cycles)

Optional SMA/RSI Filters for additional confirmation

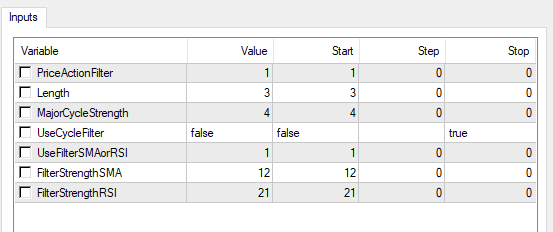

2. Input Parameters

Core Settings

ParameterDefaultDescription

PriceActionFilter1Smoothing period for the base moving average (SMMA).

Length3Lookback period for volatility adjustment.

MajorCycleStrength4Multiplier for major cycle detection (stronger trends).

Filtering Options

ParameterDefaultDescription

UseCycleFilterFALSEEnables/disables cycle-based trend filtering.

UseFilterSMAorRSI11 = SMA / 2 = RSI for secondary confirmation.

FilterStrengthSMA12SMA period for trend confirmation.

FilterStrengthRSI21RSI period for trend confirmation.

3. Indicator Buffers

The indicator uses 6 buffers (arrays storing calculated values):

Buffer IndexNameDescriptionColorStyle

0g_ibuf_104Hidden (auxiliary calculations)BlackNone

1g_ibuf_108Bearish Signals (Major Cycle)AquaThick Histogram

2g_ibuf_112Bullish Signals (Major Cycle)MaroonThick Histogram

3g_ibuf_116Bearish Signals (Minor Cycle)BlackNone

4g_ibuf_120Bullish Signals (Minor Cycle)BlackNone

5g_ibuf_124Filter Output (SMA/RSI)BlackNone

4. How It Works

Core Logic

Price Smoothing

Uses Smoothed Moving Average (SMMA) of PriceActionFilter period to filter noise.

Adjusts sensitivity based on Length (volatility scaling).

Cycle Detection

Major Cycles (Strong Trends):

Detected when price moves exceed MajorCycleStrength * Average Range.

Plotted as Aqua (Bearish) / Maroon (Bullish) histograms.

Minor Cycles (Weak Trends):

Filtered out unless UseCycleFilter = TRUE.

Optional Confirmation Filters

SMA Filter: Uses a Zero-Lag SMA to reduce lag.

RSI Filter: Applies Zero-Lag RSI for momentum confirmation.

Signal Generation

Bullish Signal (g_ibuf_112 = +1):

Price breaks above a smoothed resistance level with cycle confirmation.

Bearish Signal (g_ibuf_108 = -1):

Price breaks below a smoothed support level with cycle confirmation.

5. Trading Strategy

Entry Conditions

Buy Signal:

g_ibuf_112 turns Maroon (bullish histogram).

Confirmed by SMA/RSI filter (if enabled).

Sell Signal:

g_ibuf_108 turns Aqua (bearish histogram).

Confirmed by SMA/RSI filter (if enabled).

Exit Conditions

Take Profit: When the opposite signal appears.

Stop Loss: Based on volatility-adjusted thresholds (Length parameter).

6. Strengths & Weaknesses

✅ Advantages

Adaptive to Market Conditions: Adjusts sensitivity based on volatility.

Reduces False Signals: Optional SMA/RSI filters improve accuracy.

Clear Visuals: Histogram format makes signals easy to interpret.

❌ Limitations

Lag in Ranging Markets: May produce late signals in choppy conditions.

Complex Logic: Requires careful parameter tuning.

7. Recommended Settings

Trading StylePriceActionFilterLengthMajorCycleStrengthUseFilterSMAorRSI

Scalping1-3231 (SMA)

Swing5-10452 (RSI)

Trend-Following10+661 (SMA)

8. Conclusion

The RED MAN indicator is a powerful trend-following tool best used in strong trending markets. Its adaptive filtering helps reduce noise, while the cycle detection improves signal reliability.