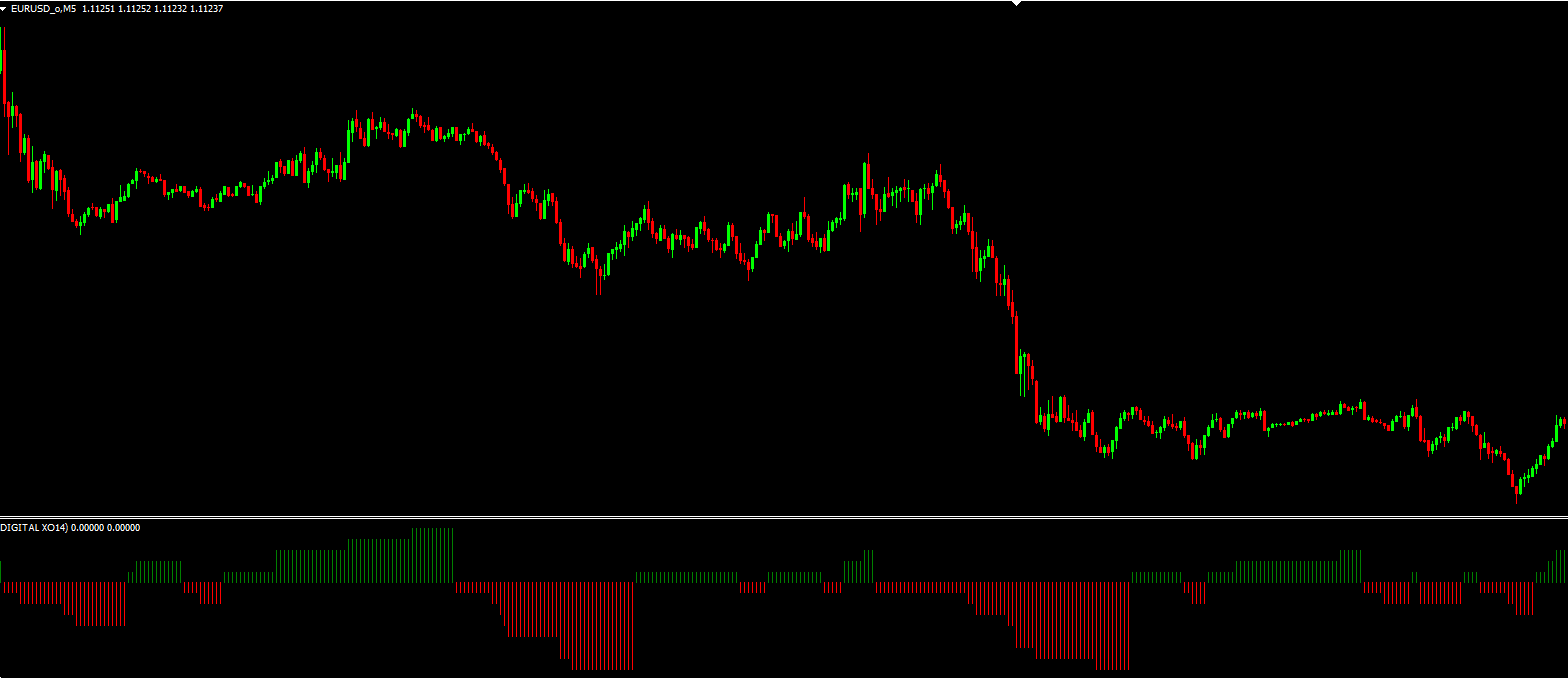

This "Sharp Eyes" indicator is an advanced tool designed to simulate and identify price changes. By utilizing ATR (Average True Range) and trend analysis, it determines key entry and exit points. The primary goal of this indicator is to simulate market movement and predict price fluctuations with high accuracy.

How the Indicator Works & Features:

ATR Calculation (Average True Range):

This indicator uses ATR to simulate price volatility. ATR helps measure the normal price changes over a specific period, and these measurements serve as the foundation for calculating future price movements.

High and Low Range Calculation:

For each candle, the indicator calculates the highest and lowest price levels. Based on price changes, the indicator calculates the high and low price areas. These changes are recalculated each time according to ATR.

Buy and Sell Signals:

Buy Signal (Green Buffer): When the price moves upward from the lower range, a buy signal is generated.

Sell Signal (Red Buffer): When the price moves downward from the higher range, a sell signal is generated.

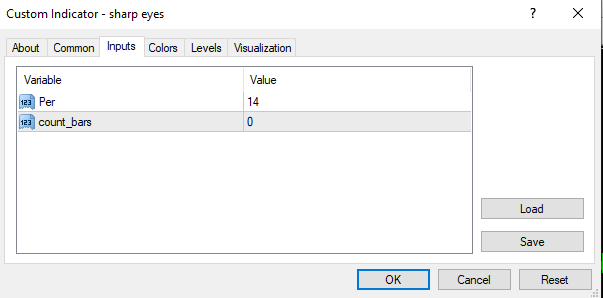

Customizable Settings:

Per: Time period for calculating ATR.

count_bars: The number of candles to use for calculations (0 means all bars).

ShowOpenCloseArrow: Displays arrows for open and close price.

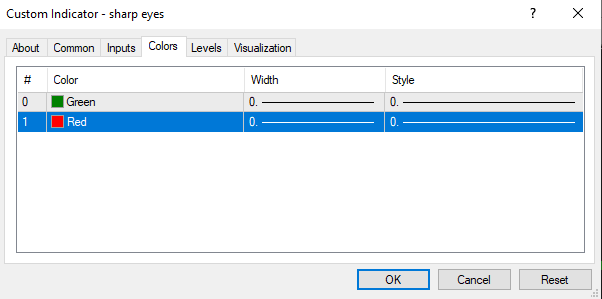

Color Settings:

Green: Associated with buy signals.

Red: Associated with sell signals.

How It Works:

The indicator continuously analyzes the market trend and generates buy or sell signals when significant price changes occur. Trend changes are simulated through price highs and lows using ATR.

Key Points:

The indicator helps you simulate market trends more accurately.

It is particularly useful for swing traders who seek rapid price changes