Swordsman Indicator - Complete Trading Guide

Indicator Overview

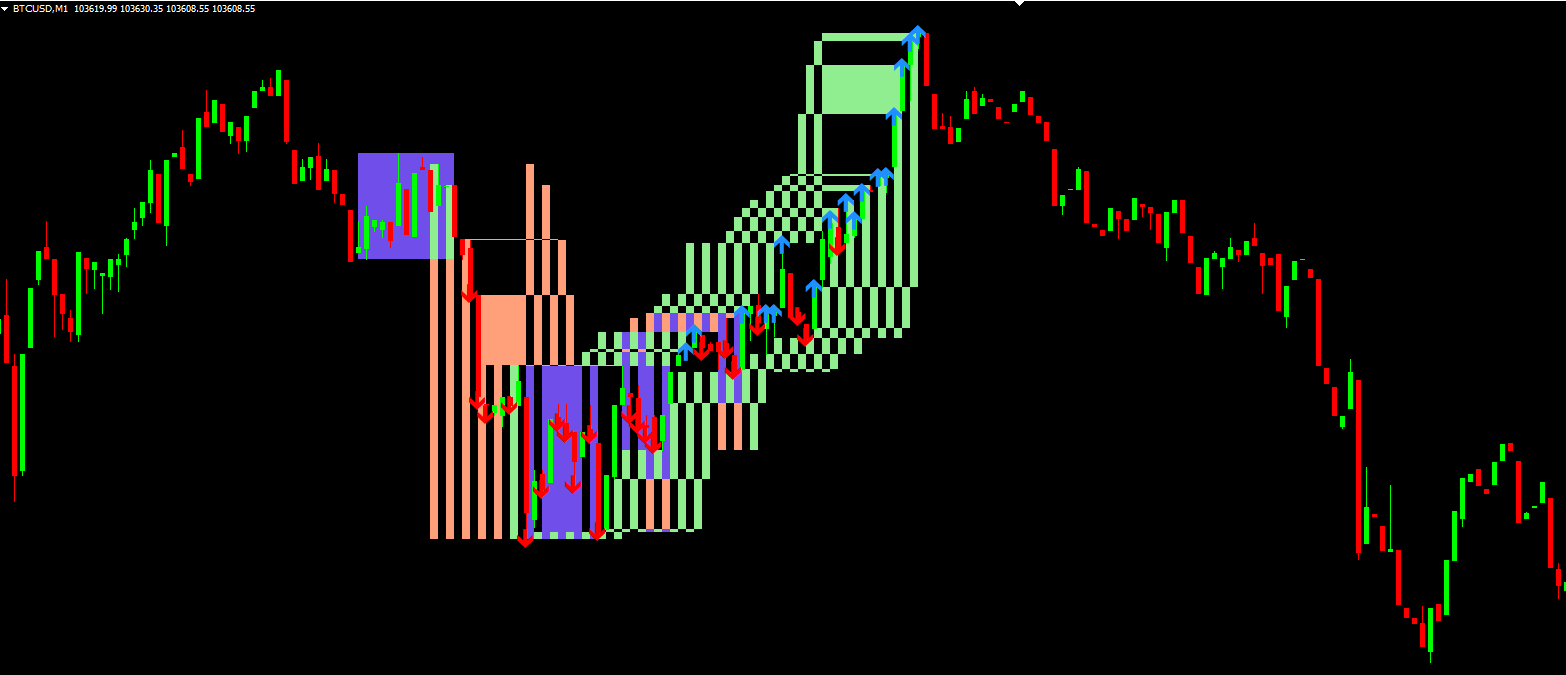

The Swordsman is a powerful trading indicator that identifies potential reversal points by analyzing price action patterns within specific time windows. It combines:

Price range analysis

Candlestick momentum detection

Visual rectangle markers

Buy/Sell arrow signals

How the Swordsman Indicator Works

Core Logic:

Time Window Analysis (22:00 GMT by default)

Scans a 12-candle period for dominant momentum (bullish/bearish)

Marks the high/low range with colored rectangles

Generates entry signals when momentum confirms

Signal Generation:

Blue Up Arrows: Appear when bullish momentum dominates

Red Down Arrows: Appear when bearish momentum dominates

Signals are placed at key breakout levels

Visual Elements:

Light Green Rectangles: Bullish zones

Light Salmon Rectangles: Bearish zones

Entry arrows appear slightly beyond the marked zones

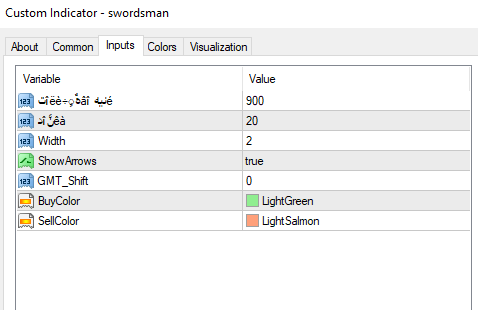

Optimal Settings

ParameterDescriptionRecommended Value

BarsCountLookback period500-1000 candles

دîنَّêàPrice offset for signals15-30 pips

WidthArrow thickness1-3

ShowArrowsToggle signal visibilityTrue

GMT_ShiftAdjust for your timezone-3 to +3

BuyColorBullish zone colorLightGreen

SellColorBearish zone colorLightSalmon

Trading Strategy

Best Timeframes:

H1 and H4 for swing trading

M15-M30 for day trading (with adjusted settings)

Entry Rules:

Long Positions:

When blue arrow appears above rectangle

Place stop loss below rectangle low

Target 1: 1.5x rectangle height

Target 2: 2x rectangle height

Short Positions:

When red arrow appears below rectangle

Place stop loss above rectangle high

Target 1: 1.5x rectangle height

Target 2: 2x rectangle height

Confirmation Tips:

Wait for candle close beyond rectangle

Combine with RSI (30/70 levels)

Look for volume spikes on breakouts

Slogan

"Precision Trading Like a Master Swordsman - Strike at the Perfect Moment!"

Pro Tips

Session Trading:

Works exceptionally well during London/New York overlap

Adjust GMT_Shift to match your trading session

Risk Management:

Never risk more than 2% per trade

Move to breakeven after 1.5x risk achieved

Filtering Signals:

Only trade arrows that align with higher timeframe trend

Avoid trading during news events

Customization:

For scalping: Reduce BarsCount to 200-300

For position trading: Increase to 1500+

Indicator Strengths

✓ Clear visual representation of trading zones

✓ Objective entry signals

✓ Adaptable to multiple timeframes

✓ Customizable colors for personal preference

Limitations

× May generate false signals in choppy markets

× Requires proper GMT adjustment

× Works best in trending conditions

Recommended Pairings:

Combine with 200 EMA for trend confirmation

Use with ATR for dynamic stop placement

Add Volume Profile for key level confirmation

Would you like me to suggest modifications to enhance this indicator's functionality? For example:

Adding alert functionality

Incorporating multi-timeframe analysis

Creating a dashboard version

Adding profit target lines