Trader Lines Indicator - Complete Guide

🏆 Motto:

"Trade with precision – let the lines guide your way to profits!"

📌 Overview

The Trader Lines indicator is a polynomial regression-based tool that plots dynamic support/resistance levels using advanced mathematical calculations. It creates a central trend line with multiple Fibonacci-based deviation channels, helping traders identify potential reversal zones and trend strength.

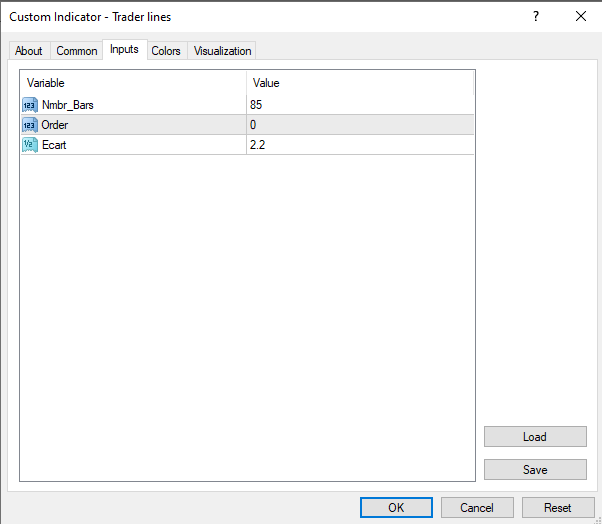

🔧 Indicator Settings

Input Parameters:

Nmbr_Bars (Default: 85) – Number of bars used for calculations.

Order (Default: 0) – Polynomial regression order (higher values create more complex curves).

Ecart (Default: 2.2) – Multiplier for standard deviation bands.

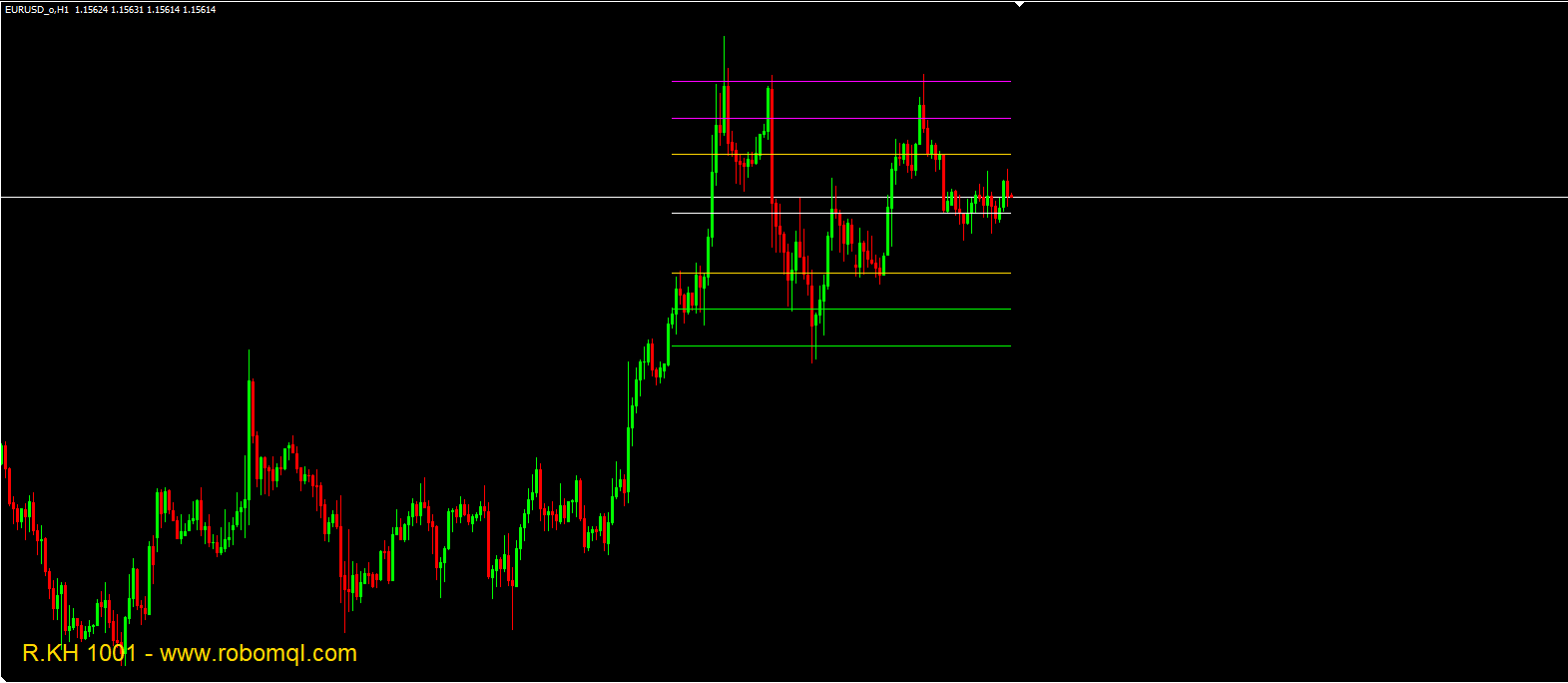

Visual Elements:

White Line: Central polynomial regression line.

Gold Lines: Inner support/resistance (Fibonacci 1.618 levels).

Fuchsia Lines: Intermediate levels (Fibonacci 1.382 levels).

Lime Lines: Outer bands (standard deviation-based extremes).

📊 How It Works

Core Algorithm:

Polynomial Regression Calculation:

Fits a curve to price data using matrix algebra (Gaussian elimination).

Adjusts complexity based on the Order parameter.

Deviation Bands:

Uses standard deviation (iStdDev) multiplied by Ecart to create dynamic channels.

Applies Fibonacci ratios (1.382 & 1.618) to plot intermediate levels.

Dynamic Levels:

Upper Bands (Resistance):

Lime = Central line + (StdDev × Ecart)

Fuchsia = Central line + (Upper Band - Central) / 1.382

Gold = Central line + (Fuchsia Band - Central) / 1.618

Lower Bands (Support):

Mirrors the same logic downward.

🎯 Trading Strategy Suggestions

Buy Signals:

When price bounces off lower Gold/Lime lines with confirmation (e.g., bullish candlestick patterns).

When price breaks above the central white line (trend reversal confirmation).

Sell Signals:

When price rejects upper Gold/Lime lines with bearish confirmation.

When price breaks below the central line in a downtrend.

Best Practices:

Combine with RSI/MACD for overbought/oversold confirmation.

Works best on H1/D1 timeframes for swing trading.

Adjust Ecart for volatility – Increase in trending markets, decrease in ranging markets.

🔍 Additional Notes

Mathematical Complexity: The indicator uses linear algebra to solve polynomial coefficients.

Self-Adjusting: The bands widen/narrow based on market volatility.

Expiration Check: Includes a 2035 year check (likely a legacy code artifact).

📜 Developer & Source

Developer: R.KH 1001

Source: RoboMQL

🚀 Trade smart, stay disciplined – the market rewards the patient! 🚀