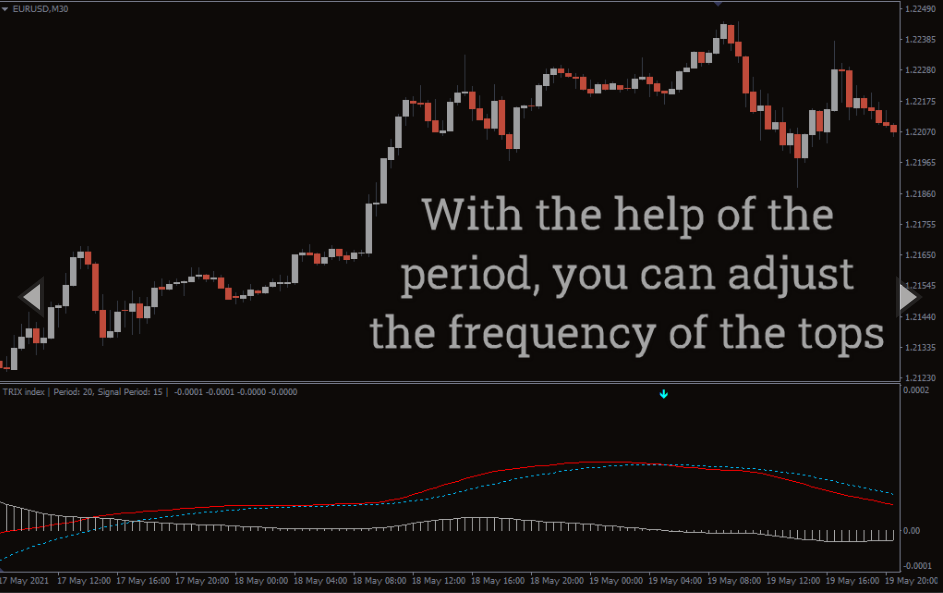

TRIX Indicator

TRIX – Triple Exponential Moving Average Indicator for MT4 provides the best forex trading signals with arrows. Best divergence indicator for price reversals.

The TRIX indicator for Metatrader 4 filters minor price changes and fluctuations that are considered insignificant for forex trading. The TRIX indicator for MT4 provides the best trading signals with arrows. Furthermore, it signals overbought and oversold conditions as the indicator is an oscillator. Additionally, the divergence between the indicator and price signals a potential reversal; thus, it also acts as the best leading indicator for technical forex and index traders. The indicator for MT4 is based on smoothed exponential moving average. It is widely used by forex and index traders to prepare the best technical trading strategy.

TRIX Indicator Trading Signals

The above EURUSD H1 chart shows the TRIX indicator for Metatrader. The oscillator is shown in a separate indicator window and displays the trading signals as arrows within the indicator window. The TRIX indicator displays the BUY signals in the YELLOW color arrow and the SELL signals in the AQUA colored arrow.

The TRIX (Triple Exponential Moving Average ) is a momentum-based oscillator, and it uses smoothed exponential moving average to calculate the trading signals. Traders can BUY once the YELLOW color arrow appears and exit the position on the opposite signal. Oppositely, traders can SELL once the AQUA color arrow appears. The traders can continue to hold the position and exit on the opposite signal.

As the indicator is an oscillator, forex traders can use it to identify overbought and oversold conditions. The TRIX indicator acts as a leading indicator because it shows divergence. Any divergence between the direction of the price movement and the indicator indicates potential price reversals. If the price moves in an upward direction while the indicator moves in the opposite direction. In that case, a reversal is impending, and forex traders can prepare a trading strategy accordingly.