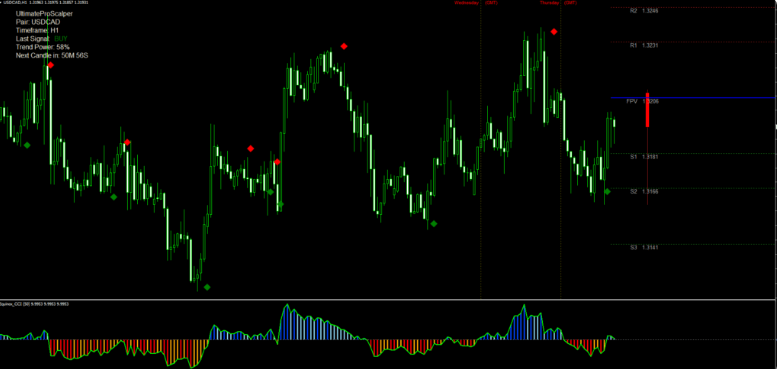

Ultimate Pro Forex Scalping System

Indicators Used in this Forex Scalping System

The Ultimate Pro Forex Scalping System integrates three essential components: the Ultimate Pro Scalper indicator, the Equinox CCI, and the TzPivotD. Together, these tools create a reliable and efficient trading environment, streamlining decision-making for traders. Understanding these elements is crucial for effectively using the scalping system and enhancing your forex trading success.

Ultimate Pro Scalper

The Ultimate Pro Scalper is an indicator designed for efficient scalping in trending markets. It displays red and green diamonds as trade signals and includes an info box at the top right corner that assesses the current trend's strength. The strength of the Ultimate Pro Scalper lies in its ability to deliver optimal results when trading in an active trend. However, it can generate false signals, which is where the Equinox CCI comes in.

Equinox CCI

The Equinox CCI is a modified Commodity Channel Index indicator developed by Russ Horn for the Equinox system. Set at a period of 50 (close), the Equinox CCI efficiently reads the medium-term trend. This color-coded indicator simplifies the identification of trend changes. It acts as a filter for the Ultimate Pro Scalper, allowing traders to discard false signals and focus on valid ones that align with the CCI direction.

TzPivotD

The TzPivotD is an enhanced pivot point indicator, offering over a dozen input parameters for customization. Pivot Points Levels are used as profit targets within the Ultimate Pro Forex Scalping System, adding an extra dimension of strategy and potential returns. These levels often represent critical support and resistance areas, enabling traders to anticipate possible price movements and adjust their strategies accordingly.

The Ultimate Pro Scalper can provide trading signals that you can take as they are, or you can enhance them with additional chart analysis, which is recommended. While traders of all experience levels can use this system, practicing on an MT4 demo account can be beneficial until you become consistent and confident enough to trade live.

Trading Rules for the Ultimate Pro Scalper

Remember to tighten your stop losses around high-impact news releases or avoid trading at least 15 minutes before and after these events when using the Ultimate Pro Scalper strategy.

As always, to achieve good results, remember proper money management. To be a profitable trader, you must master discipline, control emotions, and understand trading psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions, such as low volume/volatility, outside major sessions, exotic currency pairs, wider spreads, etc.

Buy Rules

Entry Condition: Wait for the Ultimate Pro Scalper indicator to display a green signal dot that aligns somewhat below the candlesticks. This indicates a potential uptrend in the market, signaling an excellent opportunity to buy. Concurrently, the Equinox CCI should be above the zero line, reinforcing the bullish signal.

Exit Condition: The trade should be closed when the Ultimate Pro Scalper indicator triggers a red signal dot. Ideally, this should occur at the level of a pivot point as indicated by the TzPivotD, suggesting the potential end of the uptrend.

Stop Loss Rule: For risk management, place the initial stop loss at the previous swing low. This ensures that losses are minimized if the market moves against the trade.

Sell Rules

Entry Condition: A selling opportunity arises when the Ultimate Pro Scalper indicator displays a red signal dot that aligns somewhat above the candlesticks, indicating a possible downtrend. The Equinox CCI should be below the zero line, confirming the bearish trend.

Exit Condition: Close the trade when the Ultimate Pro Scalper indicator shows a blue signal dot, preferably at the level of a pivot point. This suggests that the downtrend might be nearing its end.

Stop Loss Rule: For risk management, place the initial stop loss at the previous swing high. This strategy ensures the trade is closed before potential losses accumulate if the market unexpectedly trends upwards.