Under Control Indicator - Professional Trading Guide

Indicator Overview

The Under Control indicator is a sophisticated Fibonacci-based ADR (Average Daily Range) trading system that helps traders identify key price levels and potential reversal zones. This professional tool combines:

Dynamic Fibonacci retracement levels

Multi-timeframe ADR calculations

Customizable visual presentation

Interactive on/off toggle button

Core Trading Logic

Key Components:

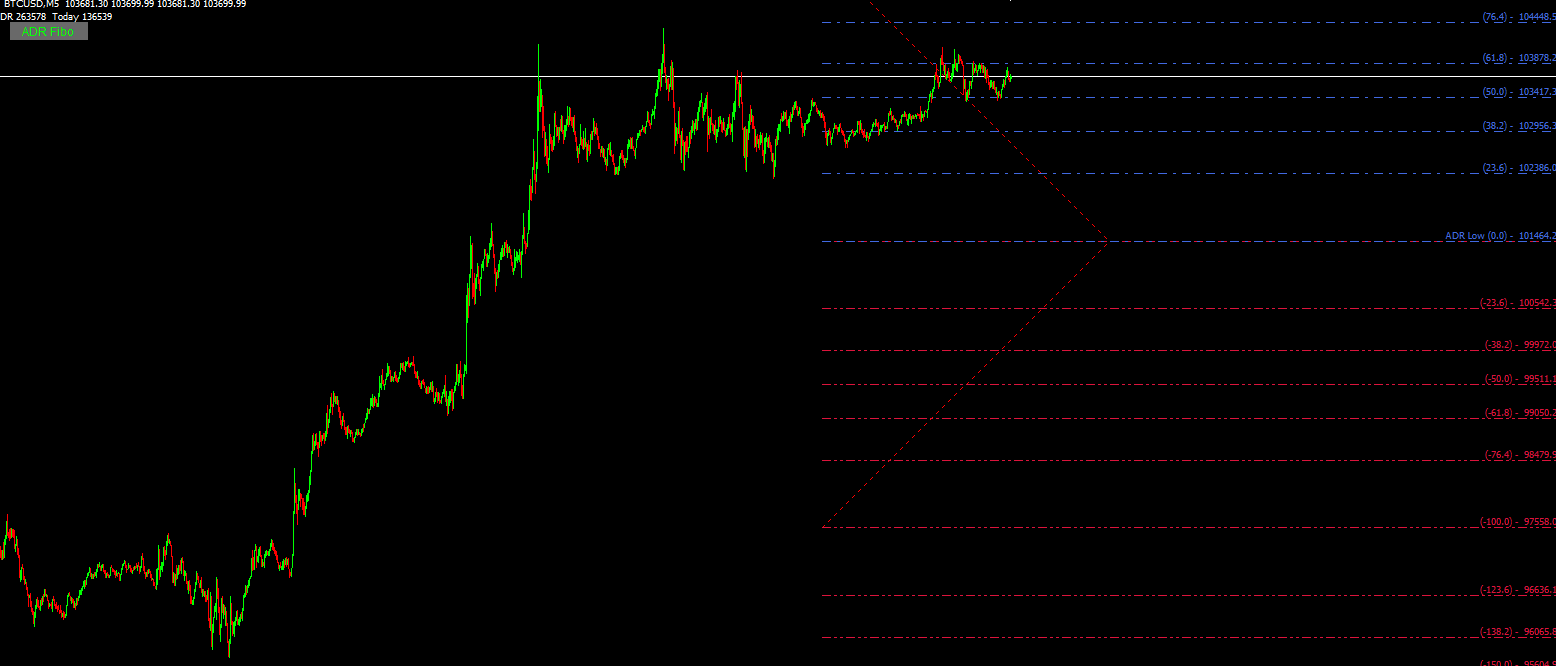

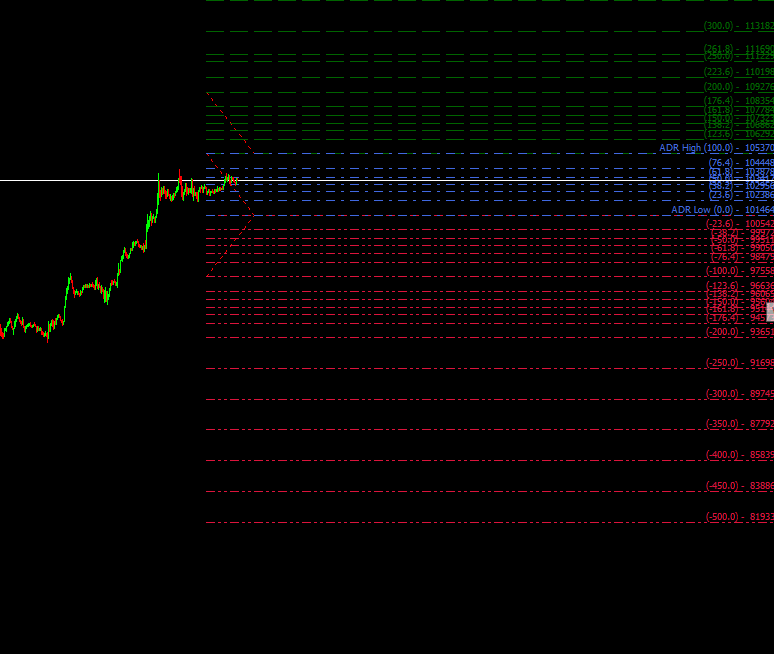

Three Fibonacci Grid Systems:

Upper Fibonacci Extension (Dark Green)

Main Fibonacci Retracement (Royal Blue)

Lower Fibonacci Extension (Crimson)

ADR Calculation:

Uses 5, 10, and 20-day average ranges

Can be manually overridden

Adjusts for different broker point values

Time Zone Adjustment:

Accommodates global trading sessions

Automatically adjusts for weekend gaps

Optimal Settings Configuration

ParameterDescriptionRecommended Values

DisplayUpperFiboShow upper extensionsTrue for full analysis

UpperFiboColorUpper levels colorDark Green

DisplayMainFiboShow main retracementsTrue for core levels

MainFiboColorMain levels colorRoyal Blue

DisplayLowerFiboShow lower extensionsTrue for full analysis

First_avShort-term ADR days5 (default)

Second_avMedium-term ADR days10 (default)

Third_avLong-term ADR days20 (default)

Professional Trading Strategy

Best Timeframe Applications:

M15-H4: Ideal for day trading

D1-W1: Perfect for swing trading

All chart types (including crypto and stocks)

Trading Signals:

Bounce Trades:

Enter long at 38.2% or 61.8% main Fib levels

Enter short at 138.2% or 161.8% extension levels

Confirm with price action reversal patterns

Breakout Trades:

Trade breaks beyond 100% ADR level

Target next Fibonacci extension level

Use closing confirmation

Range Trading:

Fade price at extreme Fib levels (0% or 100%)

Tight stops beyond the level

Advanced Techniques:

Combine with RSI divergence

Watch for cluster of Fib levels across timeframes

Use volume profile at key Fib levels

Slogan

"Master the Markets with Precision - Keep Every Trade Under Control!"

Pro Trading Tips

Session Optimization:

Best during London/New York overlap

Excellent for Asian session breakouts

Risk Management:

Use 0.5-1% risk per trade

Place stops beyond Fib levels

Take partial profits at confluence zones

Customization:

Adjust colors for better visibility

Modify ADR periods for different volatility

Use manual ADR for special market conditions

Indicator Strengths

✓ Clear visual presentation of key levels

✓ Adaptive to market volatility

✓ Works across all liquid markets

✓ Customizable for all trading styles

Performance Tips

• For forex: EUR/USD, GBP/USD, USD/JPY

• For stocks: Liquid large-caps (AAPL, AMZN)

• For crypto: BTC/USD, ETH/USD

Recommended Pairings:

Volume indicator for confirmation

MACD for momentum

Price action patterns

Would you like me to develop any of these enhancements?

Alert system for key levels

Multi-timeframe ADR comparison

Automated trade execution EA

Advanced confluence detection