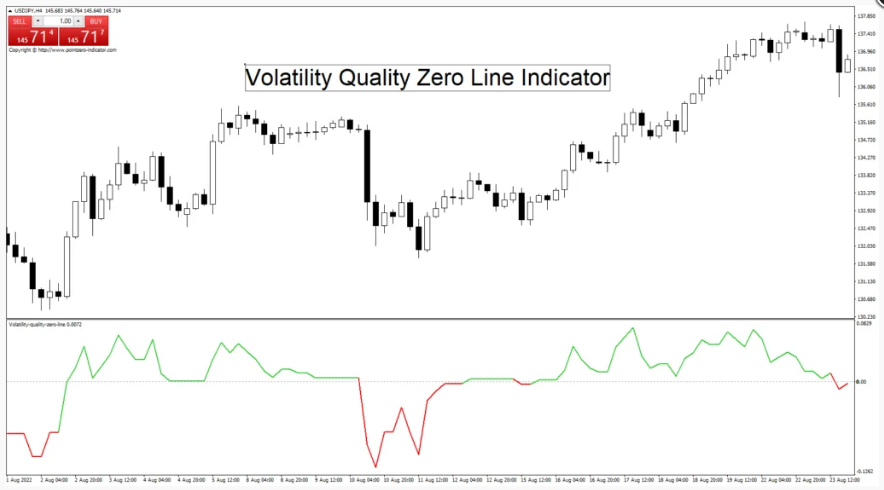

Volatility Quality Zero Line Forex Indicator for MT4

Functionality of the Forex Volatility Quality Zero Line Indicator

This Forex indicator features a volatility line that oscillates between 1 and 0 in a bullish market and between -1 and 0 in a bearish market, depending on market conditions. A value of 0 represents the least volatility, while a value of 1 or -1 indicates high volatility.

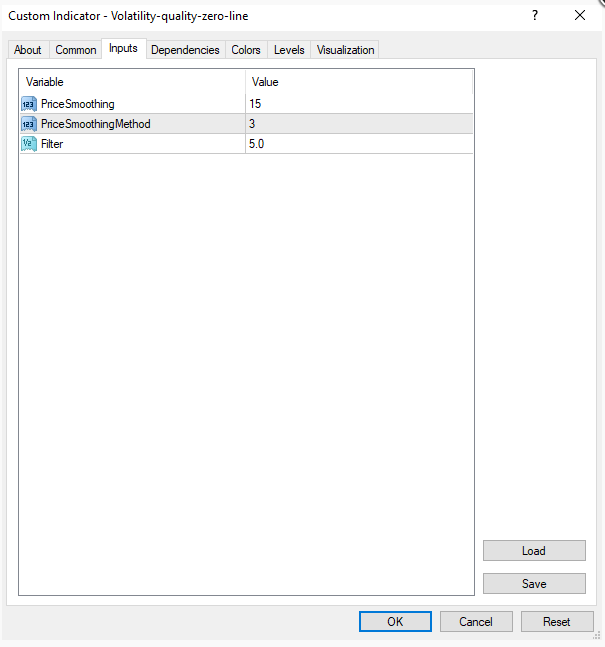

Settings for the Forex Volatility Quality Zero Line Indicator

In the indicator’s settings, you can adjust the chart price smoothing value and filter out false chart breakouts.

Trading Strategy Using the Volatility Quality Zero Line Forex Indicator

As mentioned earlier, the indicator’s volatility line turns green under bullish market conditions and red under bearish conditions. Therefore, you can enter long trades when the line changes from red to green, and short trades when the line switches from green to red.

Stop-Loss Levels

For short positions, the most recent chart swing highs act as take-profit (TP) levels, while for long positions, the most recent chart swing lows serve as TP levels when trading with the Volatility Quality Zero Line Forex Indicator.

If the swing highs or lows are too distant from the point where the indicator signals a trade, it’s advisable to avoid entering that trade.

Take-Profit Levels

For long positions, the TP level is reached when the volatility quality zero line changes from green to red. For short trades, the TP level is when the line changes from red to green.

Conclusion

Considering market volatility while trading can provide a significant advantage over other traders, as it helps identify optimal market conditions using this Forex indicator. Additionally, I recommend using this indicator in conjunction with the Relative Strength Index (RSI) for improved results.